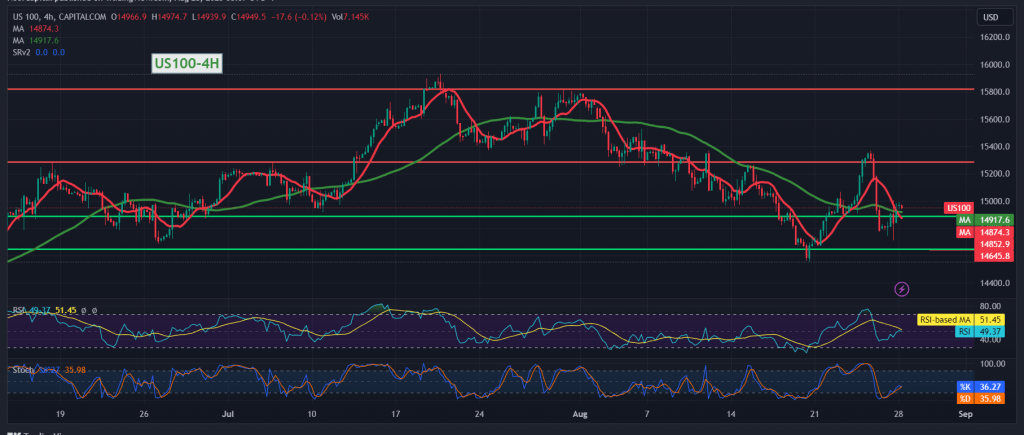

The Nasdaq Composite Index found a good support level near 14,710, which limited the bearish slope and forced the index to achieve some bullish rebound. The current movements witnessed stability around 14,950.

On the technical side today, we tend to be positive in our trading, but with caution, dependent on the stability of intraday trading above 14,770, stimulated by the RSI’s attempts to gain more bullish momentum over the short term.

There may be a bullish bias in the coming hours, targeting a retest of 15,060 as a first target, and the price’s consolidation above it is a catalyst factor that may enhance the chances of touching 15,180.

Trading stability below 14,770 can thwart the bullish scenario and lead the index to the downside direction with an initial target of 14,590, and the losses may extend later to 14,510.

Note: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations