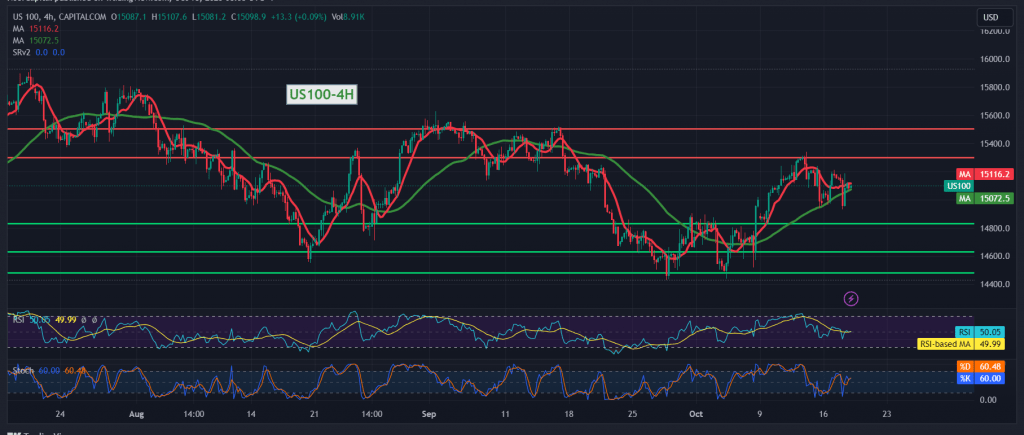

Mixed trading dominated the movements of the Nasdaq index during the previous trading session, recording its lowest level of 14,930, then returning to achieve some upward rebound and currently hovering around 15,095.

On the technical side today, we are leaning toward positivity but with caution, relying on trading stability above 15,000 in addition to attempts by the 50-day simple moving average to push the price higher, stimulated by attempts by the Relative Strength Index.

Therefore, the upward bias is the most likely, provided that we witness a breach of 151,30. The first target is 15,210, and the gains may later extend to visit 15,330.

Trading stability below 15,000 invalidates the activation of the bullish tendency, and we may witness a negative trading session, with an initial target of 14,955.

Note: The stochastic indicator is near overbought areas, and we may witness some fluctuation before obtaining the official direction.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations