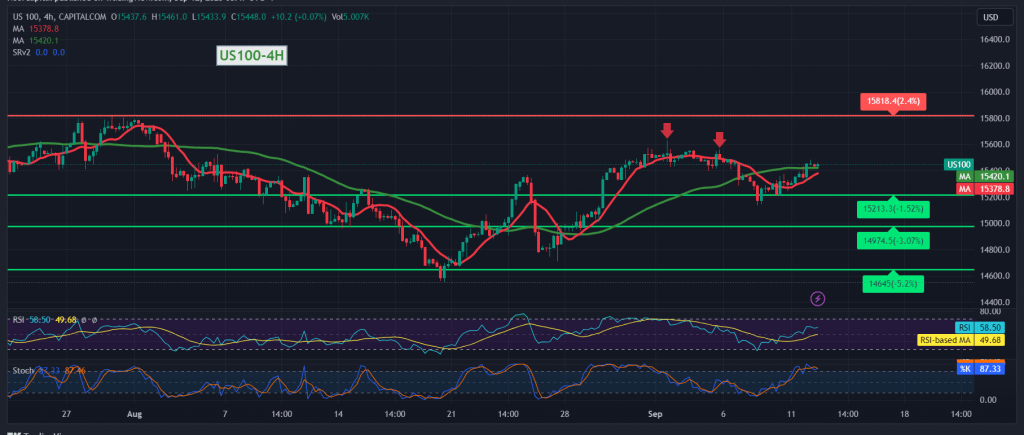

We remained neutral during the previous technical report, explaining that activating buying positions requires breaching the 15,350 value level to increase the index’s gains towards 15,400 and 15,440, with the Nasdaq index recording its highest level at 15,480.

Technically, the 50-day simple moving average is trying to provide a positive stimulus, which comes in conjunction with the positive signals from the Relative Strength Index on short intervals.

We tend to go up, but with caution, with daily trading remaining above 15,330, targeting 15,530 as the first target, and breaching it is capable of consolidating gains to visit 15,600.

Only from below, sneaking below 15,330 will immediately stop the proposed bullish scenario and lead the index to strong selling, with the initial target around 15210.

Note: The risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations