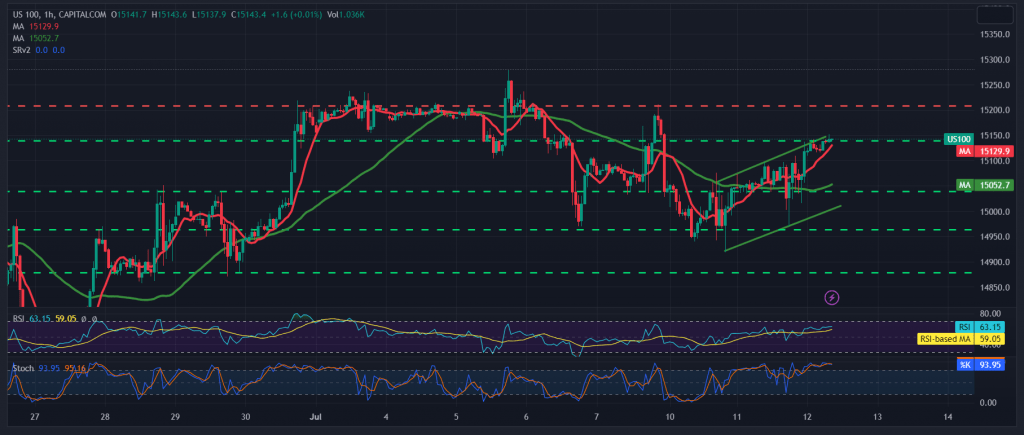

A bullish trend dominates the movements of the Nasdaq index, recording its highest level during the previous trading session around the price of 15,151, after it managed to build on the support of 14,970.

On the technical side today, we are positive in our trading depending on the positive impulse emanating from the simple moving averages and the positive momentum signals coming from the 14-day momentum indicator.

From here, and with the price consolidating above 15,080, and generally above 15,020, the bullish bias is the most favorable, targeting 15,270 as the first target and then 15,380.

We remind you that the return of trading stability again below 15,020 will immediately stop the expected bullish trend and put the index price under strong negative pressure, targeting 14,910. Note: the risk level is high.

Note: Today we are waiting for high-impact economic data issued by the US economy, “US inflation data, consumer price index”

From Canada, we are waiting for “the Bank of Canada interest statement, Canadian interest rates and the Bank of Canada press conference” \

From England, we are waiting for “the speech of the Governor of the Bank of England” and the report issued by the International Energy Agency on oil stocks. We may witness high volatility at the time of issuance of the news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations