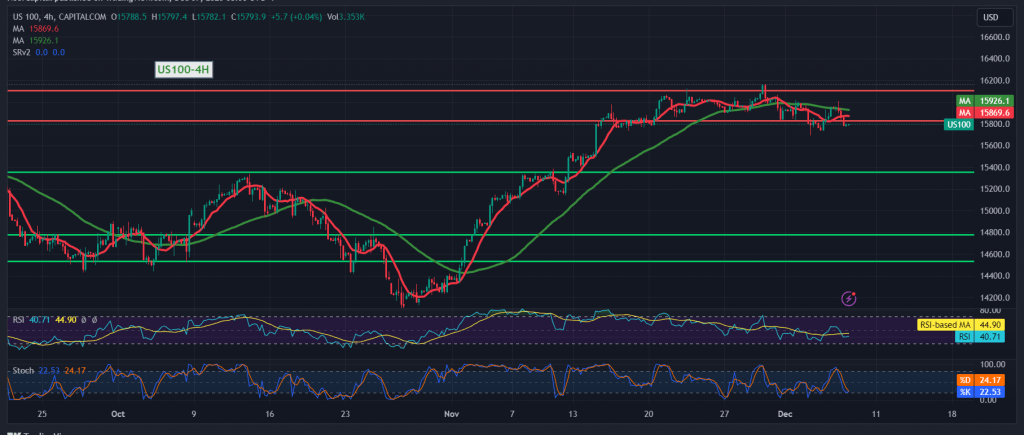

The Nasdaq index reversed the expected upward trend during the previous quarter after it found a strong resistance level near 16010, which forced it to decline, explaining that sneaking below 15880 would lead the index directly to retest 15800, recording 15793, compensating for part of the buy position.

Technically, we tend to be negative in our trading, but with caution, relying on the return of the simple moving averages to pressure the price from above, in addition to the negative signals coming from the 14-day momentum indicator.

Therefore, we may witness a bearish tendency in the coming hours, provided that we witness a clear and strong break of the support level of 15790. This will facilitate the task required to visit 15720 as a first target, knowing that breaking it may extend the losses towards 15650.

Only from above, the return of trading stability and price consolidation above 15940 invalidates the activation of the proposed scenario, and the index attempts to recover, glowing to retest 16010 and 16040, respectively.

Warning: Risks are high.

Warning: The level of risk is high amid continuing geopolitical tensions, and we may witness high price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations