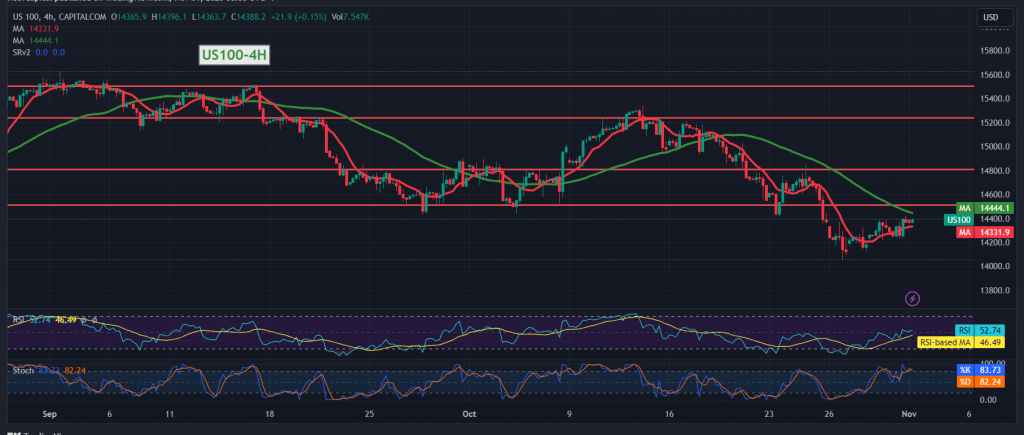

The Nasdaq index has successfully reversed its previous downward trend, aligning with our earlier analysis which hinged on maintaining trading stability below the 14,360 mark when the report was issued. To recap, an upward shift and consolidation above 14,360 would likely lead the index to mitigate its losses, with an eye on reaching 14,460. The index even surpassed this level, hitting a high of 14,420 and reclaiming a significant portion of its prior selling position.

Turning to the technical side of the market today, we observe persistent downward pressure emanating from the 50-day simple moving average. This moving average is currently impeding the index, raising the possibility of a return to a downward trajectory. In contrast, the 14-day momentum indicator is showing early signs of providing positive signals.

Amid these somewhat conflicting technical indicators, we recommend closely monitoring the indicator’s performance to gauge the likely outcome. We stand at a juncture where two scenarios could unfold:

Firstly, a breach of the 14,420 level would serve as a motivating factor, significantly increasing the likelihood of the index reaching 14,460 and potentially even soaring to 14,540. Conversely, if the index slips below the support level of 14,270, it could face negative pressure, with an initial target in the range of 14,160 to 14,170.

In summary, the Nasdaq index has shown resilience in reversing its downward course, yet the market still grapples with mixed technical signals. As we closely monitor these developments, investors should remain vigilant and be prepared to adapt their strategies based on the evolving market conditions.

A word of caution: Today, we anticipate the release of high-impact economic data from the American economy, including changes in jobs in the private non-agricultural sector, the ISM manufacturing purchasing managers’ index, the Federal Reserve Committee statement, interest rates, and the press conference of the Federal Reserve chairman. Expect significant market volatility upon the release of this news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations