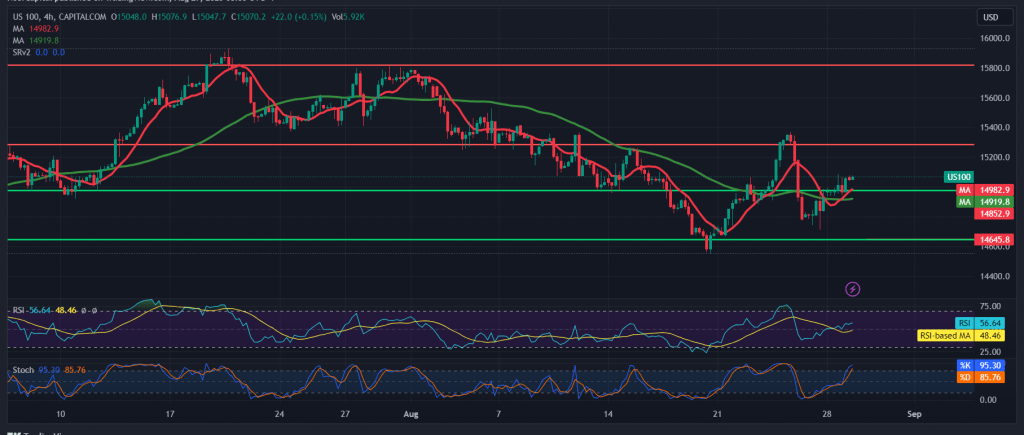

The Nasdaq index achieved remarkable gains with the start of this week’s trading within the expected positive outlook during the previous analysis, touching the first expected target 15,060, recording its highest level at 15087.

On the technical side today, we are positive in our trades depending on the positive impulse from the simple moving averages that returned to hold the price from below, in addition to the positive signals from the RSI.

Therefore, the bullish scenario remains valid and effective, knowing that the breach of 15,080 extends the index’s gains; we will be waiting for 15,130 as the first target and 15,180 as the next official stop.

Trading stability below 14,975 can thwart the bullish scenario and lead the index to the downside direction with an initial target of 14,880, and the losses may extend later to visit 14,830.

Note: The risk level may be high.

Note: Today, we await high-impact economic data issued by the US economy, “Composite Home Prices” and “Consumer Confidence.”

“Vacancies and labor turnover” and we may witness a high price fluctuation at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations