The Dow Jones Industrial Average witnessed mixed performance during the previous session, with a slight bearish tilt, consistent with the technical expectations outlined in our prior analysis.

Technical Outlook:

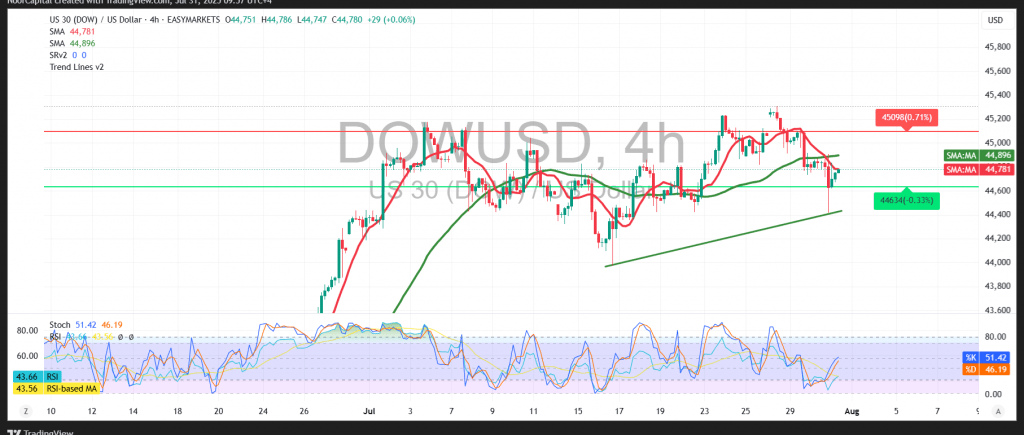

The index continues to trade below the 50-period Simple Moving Average (SMA), which acts as a dynamic resistance level and limits any sustained upside movement. However, early positive signals are beginning to emerge from the Relative Strength Index (RSI), suggesting an attempt to regain bullish momentum and support a potential recovery phase.

Likely Scenario:

If daily trading stabilizes above the 44,485 support level, selling pressure may ease, opening the door for a bullish recovery targeting the 44,975 level. A successful breach of this resistance could further extend gains toward the 45,180 zone.

Alternative Scenario:

Failure to maintain stability above 44,485 would likely subject the index to renewed downside pressure, potentially leading to a retest of the key support area at 44,250.

Key Risk Events – Volatility Alert:

Today’s session is expected to be highly volatile as investors await several high-impact U.S. economic indicators:

- Weekly Unemployment Claims

- Core Personal Consumption Expenditures (Core PCE)

- Employment Cost Index (Quarterly)

These reports may significantly influence market sentiment and drive short-term price action.

Warning:

With persistent trade and geopolitical uncertainties, the risk level remains elevated. Traders should exercise caution and prepare for swift market reactions across scenarios.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations