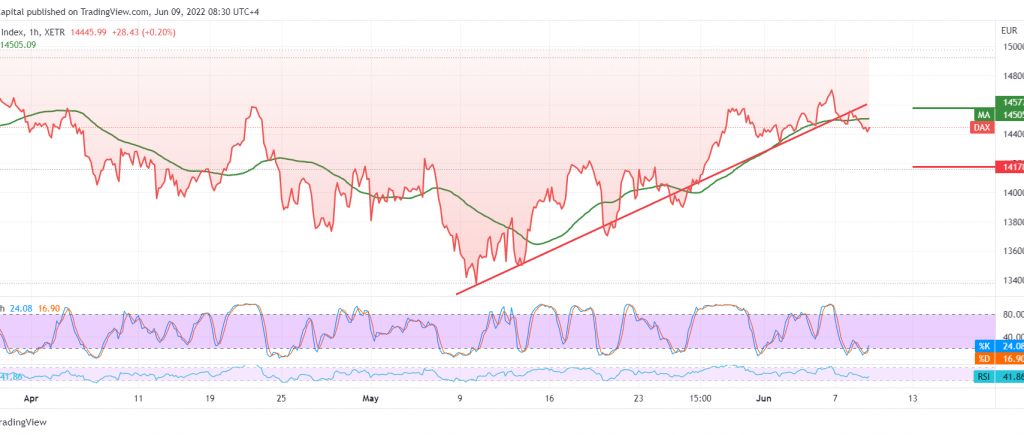

Trading tends to limit negativity dominates the movements of the German DAX index after it recorded its highest level of 14,614.

On the technical side, today, the simple moving averages started to pressure the price from above and the stability of the 14-day momentum indicator below its mid-line on the short time frames.

Therefore, the bearish tendency in the coming hours is the most preferred, provided that we witness stability below 14,350 to target 14,280 first target, knowing that the decline below the mentioned level may extend the index’s losses, opening the door to visit 14,180 as long as the price is stable below the 14,500 resistance level.

Stability above 14,500 leads the index to a bullish bias, its initial target 14,545, and it may extend later to visit 14,600.

NOTE: The risk level may be high.

Note: ECB monetary policy statement and press conference are due today and may cause some volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations