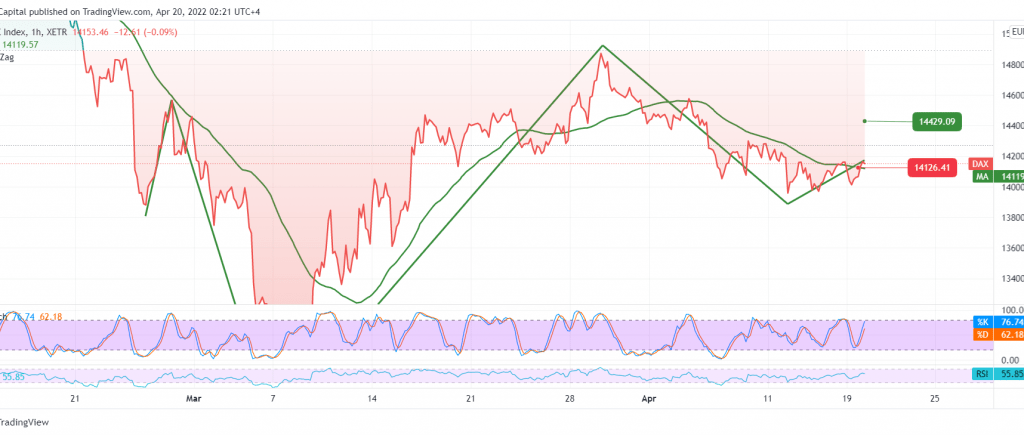

The German DAX index achieved the first target we mentioned in the previous analysis, at 14,340, recording its highest level at 14,396.

Technically, we notice the index’s pivot above the support level of 14,210, and we also find the 50-day moving average continuing to hold the price from below. Therefore, the bullish scenario may be the most preferred today, knowing that trading above 14,390 is a motivating factor that may increase the chances of visiting the areas of 14,450, the first target, and then 14,540 Straight.

Trading stability below 14,200 can thwart the suggested scenario and put the index under negative pressure, with its initial target of 14,055.

Note: The risk level is high.

Note: CFD trading involves high risk; all scenarios may occur.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations