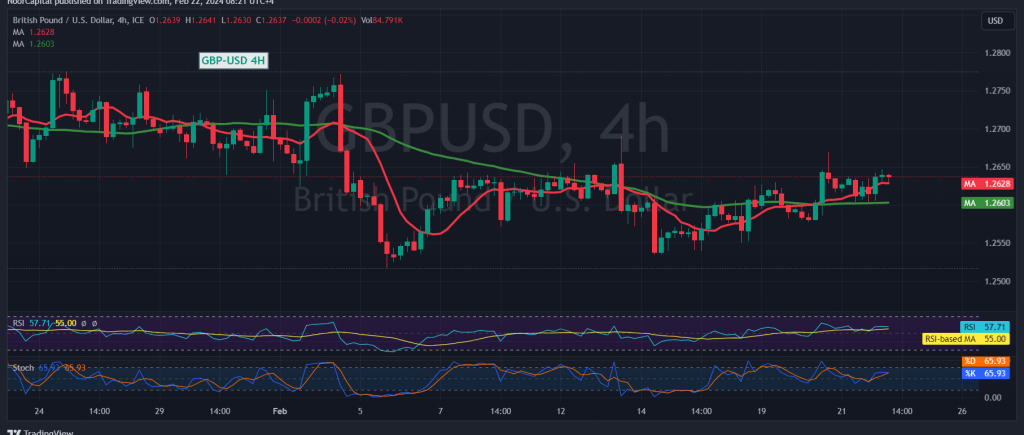

Amidst a relatively unaltered landscape, the pound sterling’s movements against the dollar remain subdued, encapsulating limited positivity within the confines of a sideways trajectory. Notably, this trend persists, with movements oscillating between 1.2600 and 1.2650.

Technical Analysis Insights

A meticulous examination of the 4-hour chart reveals consistent technical dynamics. Simple moving averages continue to furnish positive incentives, bolstering the prospect of an upward surge. Moreover, intraday stability above the critical 1.2580 support level reinforces this outlook.

Cautious Optimism Prevails

Optimism permeates the outlook, albeit cautiously. Sustained consolidation above the 1.2650 resistance level augments the likelihood of an upward surge, with initial targets set at 1.2675 and subsequently 1.2720, marking the next official station.

Potential Downside Risks

However, prudence is warranted. Failure to breach the 1.2650 threshold and a subsequent return to stability below 1.2580 could derail upward aspirations, ushering the pair towards the official bearish trajectory. Initial targets in this scenario reside at 1.2550 and 1.2530, with further losses potentially extending towards 1.2485.

Indicators and Cautionary Notes

Market participants are cautioned to remain vigilant amidst the release of high-impact economic data. Anticipate updates on the preliminary readings of the services and manufacturing PMI indices from France, Germany, and the United Kingdom, alongside key indicators from the United States. Expect heightened volatility during these news releases.

Risk Advisory

The prevailing risk level remains elevated, underscoring the need for confirmation of expected trends. Traders are advised to exercise caution and await conclusive signals before committing to positions.

By staying attuned to critical levels and potential reversal scenarios, traders can navigate the fluctuations within the pound sterling-US dollar pair with heightened precision and confidence.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations