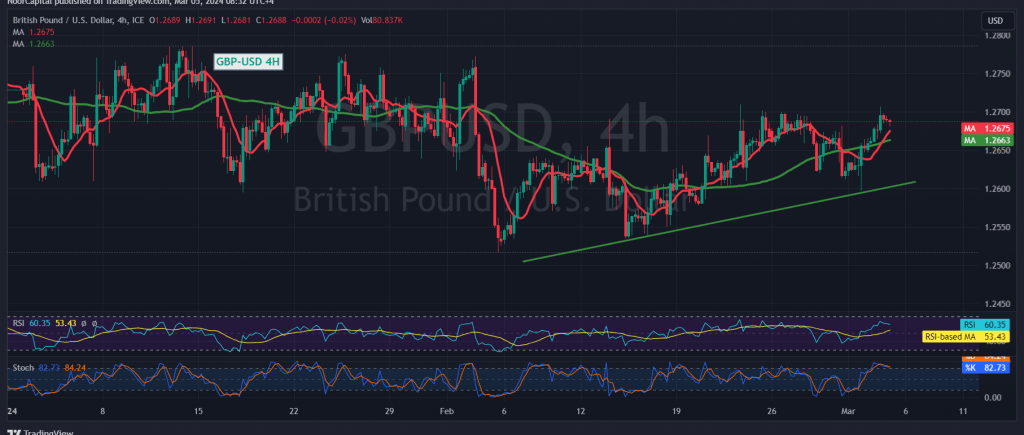

Yesterday, the pound sterling traded calmly against the US dollar, confined within a sideways range. The range was limited below the 1.2650 mark and above the strong resistance level near the psychological barrier of 1.2700.

Looking at the technical aspects today on the 4-hour chart, the pair has found stability above the 1.2650 support level, with the price also settling above the 50-day simple moving average.

Given this setup, we hold a positive outlook. A breakthrough above 1.2720 would pave the way for further upward movement towards 1.2760, with potential gains extending to 1.2780 and 1.2810, respectively.

However, a return to stability below 1.2650 could invalidate this scenario and exert downward pressure on the price. In such a case, the pair might target a retest of the 1.2600 level before potential attempts at recovery.

Investors should exercise caution, especially with high-impact economic data expected from the American economy today, particularly the Services Purchasing Managers’ Index issued by the ISM. This release may lead to increased volatility in the market.

In summary, while the pound sterling shows signs of stability and potential upward movement, traders should remain vigilant and adapt their strategies accordingly, considering the impact of upcoming economic data releases.

By staying attuned to critical levels and potential reversal scenarios, traders can navigate the fluctuations within the pound sterling-US dollar pair with heightened precision and confidence.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations