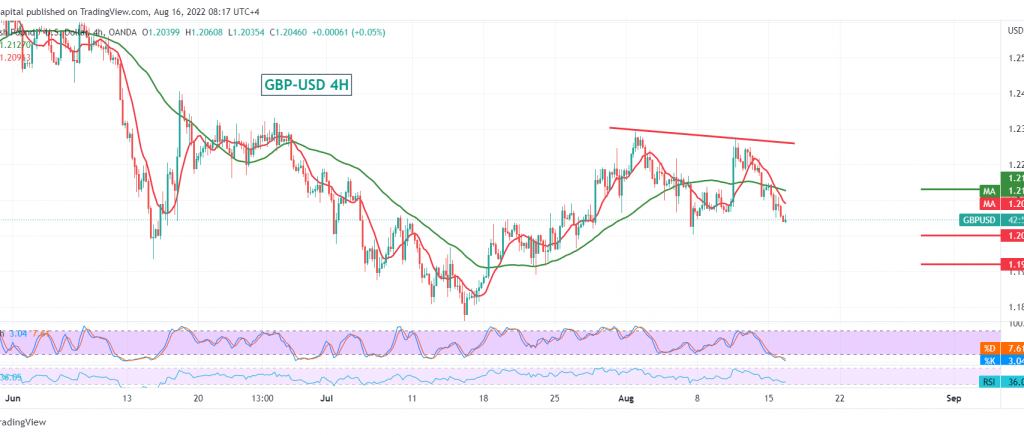

Strong negative trading dominated the movements of the pound sterling against the US dollar, achieving losses below the 1.2100 level, recording the lowest level at 1.2046.

On the technical side, the Pound confirmed breaking the strong support level 1.2075, as well as the clear negative crossover on the simple moving averages that support the daily bearish price curve and the bearish technical structure that indicates the possibility of a decline.

Therefore, the bearish scenario remains the most preferred today, targeting 1.2000, knowing that the decline below the target level will initially extend the losses to be waiting for 1.1960 unless we witness a return to trading and consolidation above 1.2130.

Consolidation above the resistance level of 1.2130 will lead the pair to recover temporarily and target a retest of 1.2190.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations