We adhered to intraday neutrality during yesterday’s session, explaining that although we tend to have a bullish bias, we preferred to wait to confirm the breach of 11830 targeting 1.1860, to record the highest level at 1.1865.

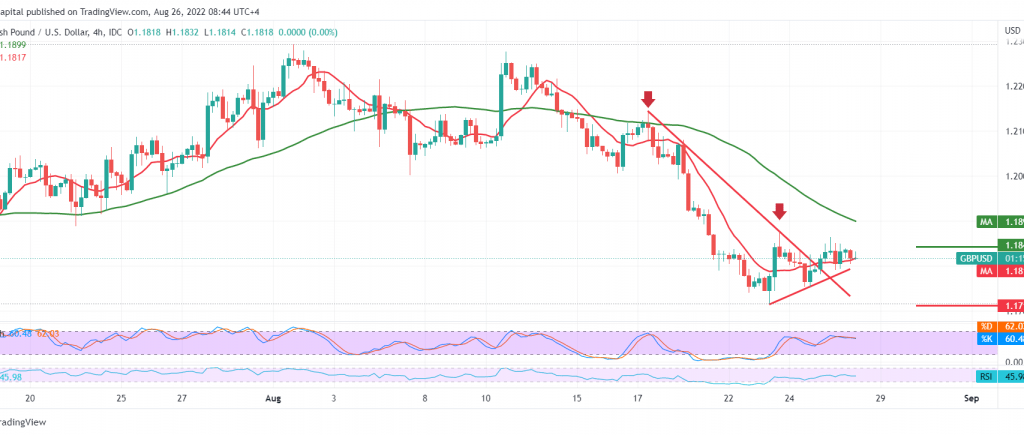

Technically, the pair’s current moves are witnessing stability below 1.1840/1.1830, accompanied by negative pressure from the simple moving averages that returned to pressure on the price from above.

Therefore, the expected tendency for today’s session is bearish, targeting 1.1780/1.1770, a first target, knowing that breaking the mentioned level will extend the pair’s losses, so we will be waiting for 1.1720 unless we witness a consolidation of the price again above 1.1830

Note: Throughout today’s session, the “Jackson Hole” economic forum is being held, and it has an essential impact on the markets, and we may witness random movements.

Note: We are awaiting the speech of “Jerome Powell” Chairman of the Federal Reserve later in today’s session, during “Jackson Hole” and we may witness high volatility in prices.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations