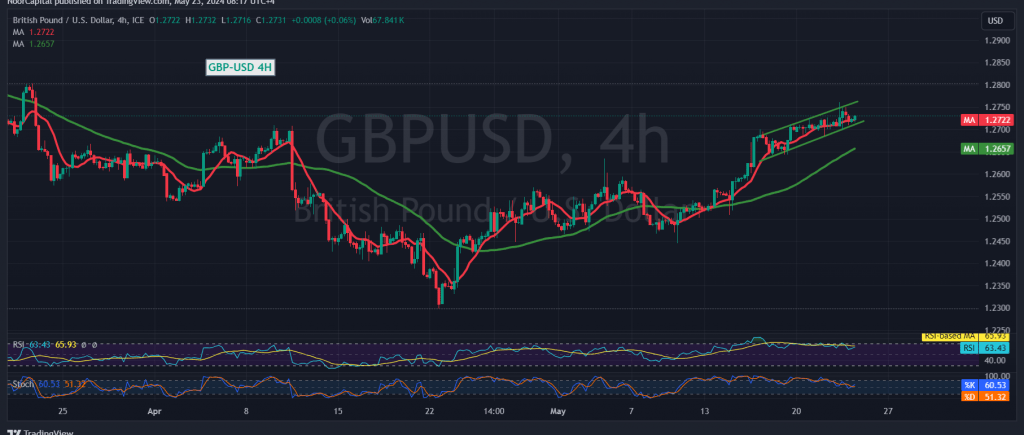

The British pound remained stable against the US dollar, maintaining its positive stance above the 1.2700 level. The technical outlook has not changed significantly.

A detailed examination of the 4-hour chart reveals several indicators suggesting a potential upward movement:

- Stochastic Indicator: The Stochastic is gaining positive momentum, indicating a possible bullish push.

- Simple Moving Average (SMA): The price stability above the 50-day SMA further supports a bullish scenario.

Given these indicators, the possibility of an upward trend remains valid, contingent upon the price holding above the critical psychological support level of 1.2700. The targets for this bullish scenario are:

- 1.2750: The immediate resistance level.

- 1.2800: The next resistance level.

If the price falls below the 1.2700 level, the bullish scenario would be invalidated, exposing the pair to negative pressure with potential targets at:

- 1.2650: The first downside target.

- 1.2630: The next support level.

Economic Data and Market Volatility

Today’s market may experience increased volatility due to the release of key economic data from major economies, including:

- France and Germany: Preliminary readings of the Services and Manufacturing PMI indices.

- United Kingdom: Preliminary reading of the Services and Manufacturing PMI indices.

- United States: Preliminary reading of the Services and Manufacturing PMI indices.

Traders should closely monitor the 1.2700 level for signs of price consolidation or a potential breakdown. Given the expected high-impact economic data, effective risk management strategies are essential to navigate potential market volatility.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations