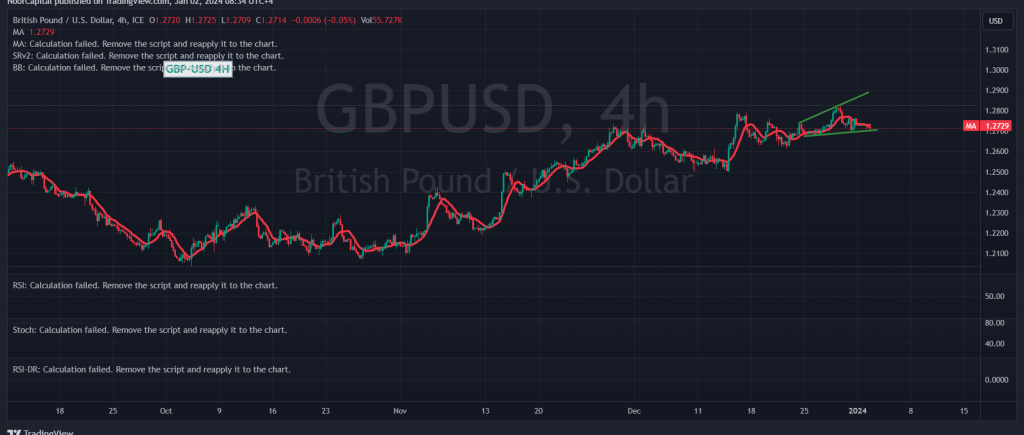

The British pound is persistently striving to maintain a bullish stance against the US dollar, and ongoing movements indicate efforts to establish stability above the 1.2700 level.

From a technical perspective, a closer examination of the 240-minute time frame chart reveals that the simple moving averages continue to offer crucial support for the pair. This support is further reinforced by positive signals emanating from the 14-day momentum indicator.

Given the current intraday trading stability above 1.2700, there is an increased likelihood of the upward trajectory persisting, targeting 1.2760 as the initial objective. It is important to note that surpassing 1.2760 serves as a motivating factor, amplifying the prospects of reaching 1.2800 and subsequently 1.2840.

However, it’s essential to exercise caution. The return to trading stability below 1.2700, coupled with the closure of at least a one-hour candle, may temporarily postpone the chances of an upward move. This adjustment, however, does not completely negate the possibility, and there could be a temporary bearish tendency with the aim of retesting 1.2660 before resuming an upward trajectory.

Traders are advised to be vigilant as the risk level is deemed high in the current market conditions. It’s crucial to closely monitor developments and adjust strategies accordingly.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations