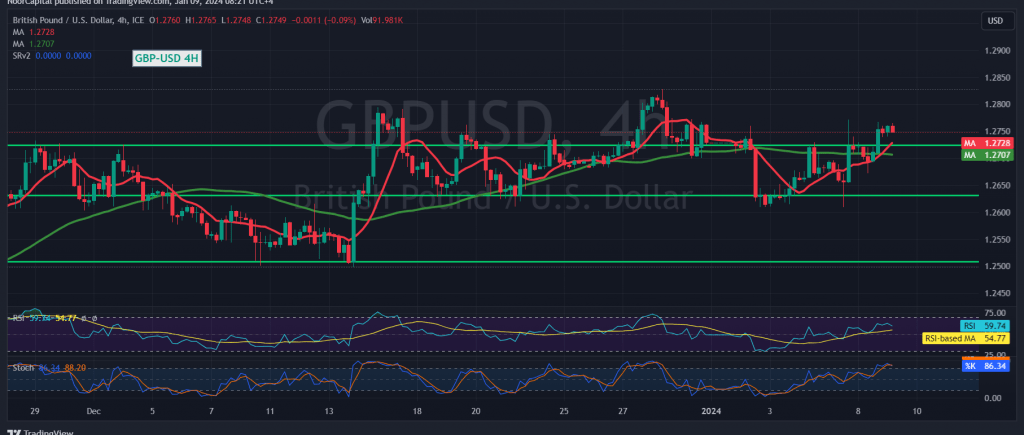

Positive attempts have resurfaced in the pound-dollar pair, establishing immediate stability above the 1.2720 resistance level and reaching a peak at 1.2765.

From a technical perspective, a closer examination of the 4-hour chart indicates that the 50-day simple moving average is providing positive support, signaling the potential for an upward move. This aligns with clear positive signs on the 14-day momentum indicator.

As long as intraday trading maintains levels above 1.2700, there is a possibility of an upward trend with an initial target at 1.2785, followed by 1.2820 as the subsequent station.

It’s crucial to note that the scenario outlined above would be invalidated if trading stability falls back below 1.2695. In such a case, the pair could revert to a downward trajectory with targets at 1.2640 and 1.2600, respectively.

A word of caution: The Stochastic indicator is displaying negative signals, and the risk level is deemed high. Traders are advised to exercise caution and be mindful of potential volatility in the market.

A cautionary note is warranted as the risk level is deemed high, underscoring the importance of vigilance in the current market conditions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations