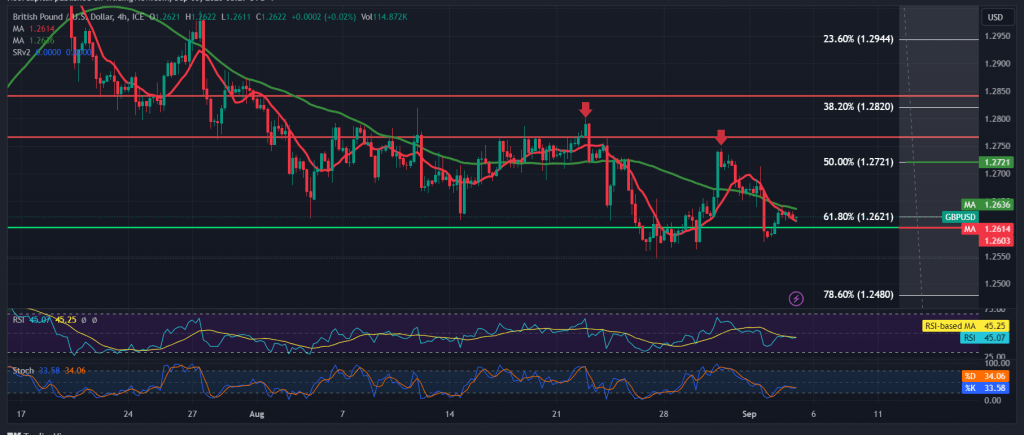

Negative trading dominated the movements of the pound sterling against the US dollar at the end of last week’s trading, recording its lowest level at 1.2578.

Technically, by looking at the 4-hour chart, intraday trading remains stable below pivotal resistance 1.2625, Fibonacci retracement 61.80%, which supports the possibility of a decline accompanied by negative pressure on the 50-day simple moving average, in addition to the clear negative signals on the Stochastic indicator.

Therefore, the possibility of continuing the decline is still valid and effective, targeting 1.2560 as the first target, and breaking it constitutes a negative pressure factor on the pair, as we wait for 1.2500, the next official station.

From above, the 4-hour candle closes above the main resistance 1.2625, the 61.80% correction is capable of foiling the proposed scenario and leading the pair to upward attempts with targets starting at 1.2690 and 1.2720.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations