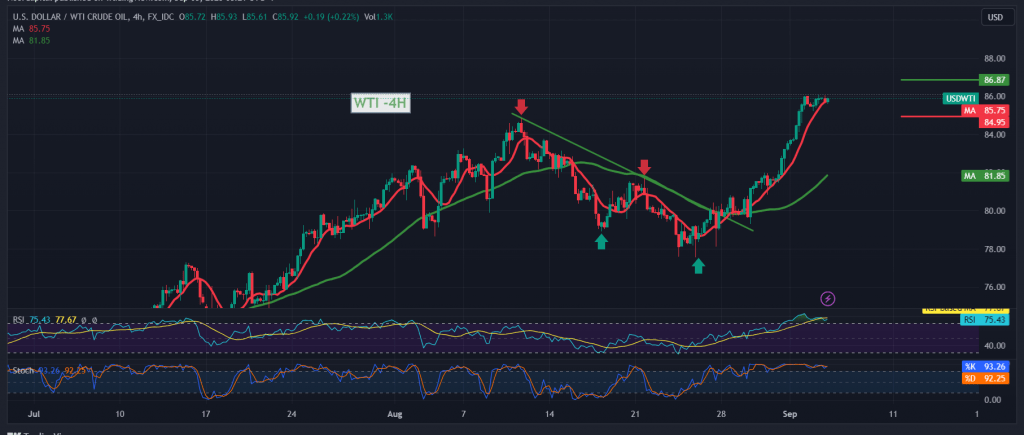

US crude oil futures prices continue to form an upward attack within the expected bullish context at the end of last week’s trading, exceeding the required target of 85.30, recording its highest level of $86.10 per barrel.

Technically, oil prices continue to receive a positive stimulus from the simple moving averages that support the continuation of the upward curve of prices and are stimulated by the clear positive signals on the Relative Strength Index. On the other hand, we find the Stochastic indicator clearly on the cusp of overbought.

We tend to be positive, but with caution, relying on the stability of intraday trading above 85.00/84.90, targeting 86.85 as the first target, knowing that breaching it increases and accelerates the strength of the upward trend, so we are waiting to touch 78.75, an awaited station.

Activating the proposed bullish scenario depends mainly on trading stability above 84.90, and breaking it will force oil prices to form a corrective decline with an initial target around 84.00 and 83.50.

Note: Risk level may be high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations