The Treasury market is focusing on short-term debt with a 4%-plus yield as the Fed gears up to lower rates and support a soft landing. This sentiment is driven by the belief that the economy may avoid a recession and investors’ lack of appetite for longer-term securities. The two-year Treasury is the sweet spot on the yield curve, offering an attractive yield of around 4.4%.

The Fed revealed most of their 2024, 2025’s rate outlook, so rates are going lower. Investors now tend to favor a mixture of two-year and five-year bonds as out the curve is not where most analysts see much value. Long-term debt is poised to underperform, as traders want to be compensated for the added risk they see embedded in these securities.

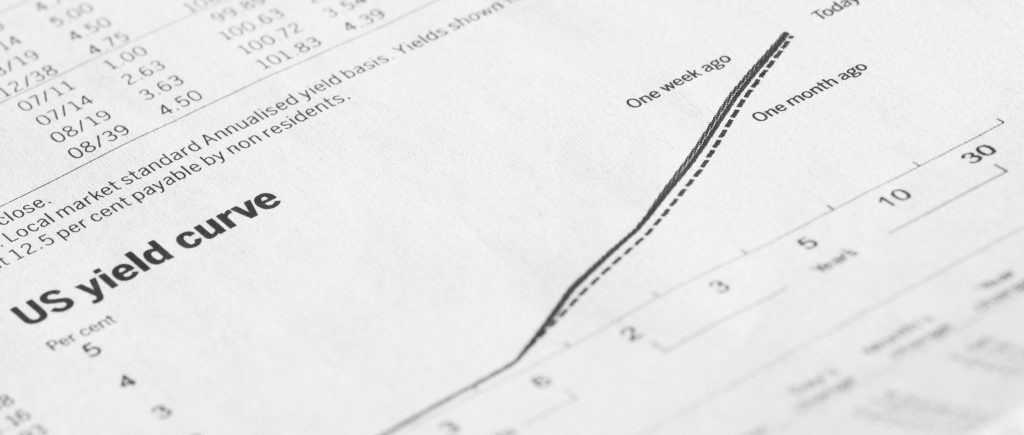

The two-year note appeals from a look at the yield curve, which first inverted this cycle over a year-and-a-half ago, resulting in long-term rates trading below those on debt with shorter tenors. A groundswell of investors is wagering it will flip back to a more usual pattern sometime next year. At present, the 10-year note yield is about 50 basis points below that on debt with two years to maturity.

US 10-year yields will fall toward the low 3%-range next year as a positive slope could surface by the end of 2024. Fed policymakers penciled in no further interest-rate hikes and left the target range at between 5.25% to 5.5%. Officials’ quarterly projections showed 75 basis points in cuts next year, with the federal funds rate dropping to 3.6% by the end of 2025 and then declining to 2.9% a year later.

Skilled investors now prefer to bypass 2 years and buy 5-years and further out, because there is some risk around whether the Fed will stick a soft landing. The sudden shift in the bond market has highlighted the sense that 5% Treasury yields were too good to pass up, extending a rally for many fixed income funds that not so long ago were expecting another poor performance this year.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations