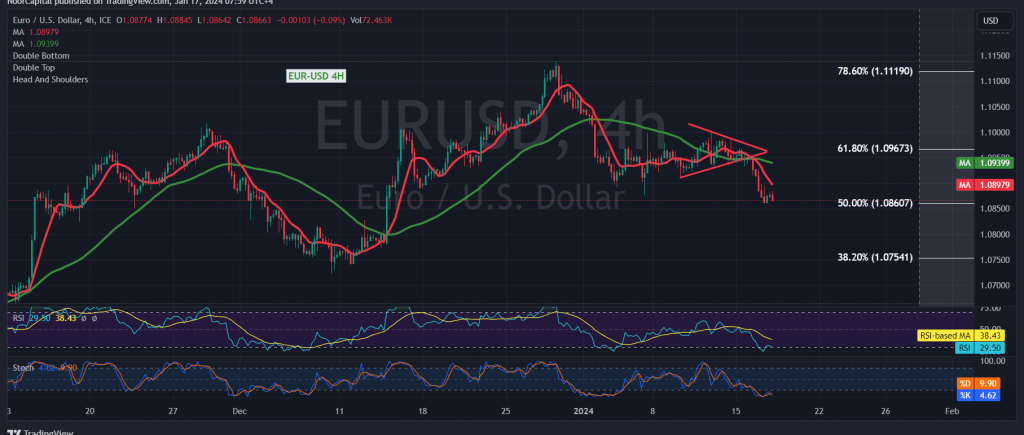

The EUR/USD pair has conformed to the anticipated negative outlook outlined in the previous technical report, reaching the officially targeted level of 1.0865 and hitting a low at 1.0862.

In terms of technical analysis today, examining the 240-minute time frame chart reveals continued pressure from the simple moving averages from above. This is coupled with evident negative signals on the Relative Strength Index (RSI), which remains below the 50 midline.

Given the sustained daily trading below the primary resistance level at the current trading levels of 1.0960 (Fibonacci correction 61.80%), the preference remains for a downward trend. The next target is 1.0800, and breaking this level paves the way for the official target at 1.0750 (correction 38.20%).

It’s crucial to note that a price consolidation above 1.0960, confirmed by the closure of at least an hour candle, would defer the likelihood of a decline, and positive attempts might be witnessed, targeting a retest of 1.1000.

Caution: Significant economic data is expected today, including “retail sales” from the United States and “annual consumer prices” from the United Kingdom. We may observe heightened price fluctuation at the time of the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations