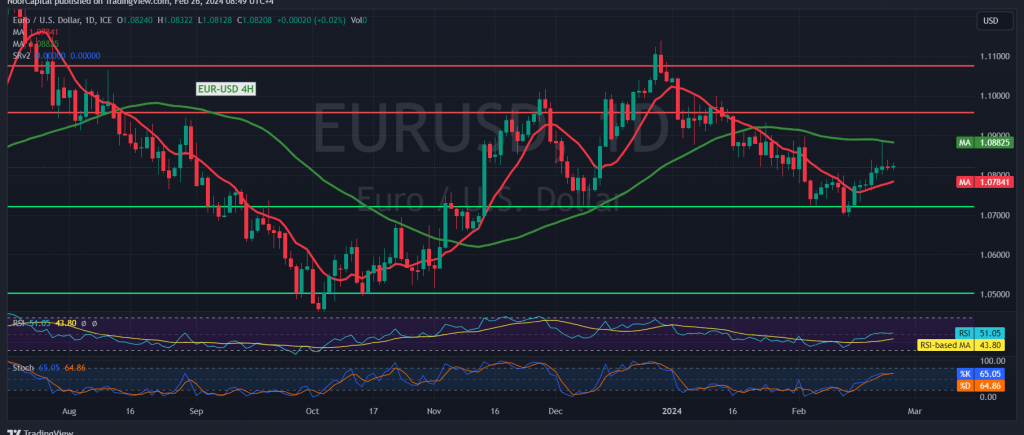

Trading in the EUR/USD pair saw a return below the pivotal resistance level of 1.0860, leading to negative movements with the pair currently stabilizing around 1.0820.

From a technical perspective today, analysis of the 4-hour chart indicates that the 50-day simple moving average is exerting downward pressure, coupled with trading below the 1.0860 level, reinforcing a negative outlook. However, the Stochastic indicator shows attempts to generate positive signals, alongside stability above the psychological barrier of 1.0800, supporting a positive bias.

Given conflicting technical signals, it’s prudent to observe the pair’s price action to determine the next move:

- Breaching the resistance at 1.0860 could trigger gains towards 1.0930 and 1.0965. Conversely, slipping below 1.0790 may intensify negative pressure, targeting 1.0760 and 1.0740.

Warning: Exercise caution and closely monitor the pair’s movements for clearer direction.

Caution: Trading in CFDs carries inherent risks. Therefore, the scenarios outlined above are possibilities, and the analysis provided should not be construed as a recommendation to engage in buying or selling activities. Instead, it serves as an illustrative interpretation of price movements depicted on the chart. It’s crucial for traders to conduct thorough research, assess their risk tolerance, and consider seeking advice from financial professionals before making any trading decisions.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations