Last week’s trading closed with risk-linked assets overperforming safe haven assets, leading to a weekly loss in the US dollar versus gains for gold as well as US stocks over the week, as most risk assets kept surging.

An interesting competition was strong between the minutes ff the Fed’s last policy meeting on the one hand, and the earnings reports in addition to economic data on the other hand. FOMC minutes shed light on a tendency within the US central bank’s policymakers to delay interest rate cuts in the near future until they are certain that inflation will continue to decline.

The emergence of this tendency led to a significant decline in expectations concerning a rate cut, which would greatly contribute to supporting the US dollar and assets that are linked to the Greenback as US Treasury bond yields surged.

On the other hand, the earnings report of the giant chipmaker Nvidia was released, achieving revenues of more than 260% in 2023’s Q4, driven by sales of products mainly related to artificial intelligence.

Nvidia’s results brought about a significant rise in global stock indices in general, led by the New York Stock Exchange indices, which made remarkable progress on a weekly basis, as the Dow Jones Industrial Average, Standard & Poor’s 500, and Nasdaq Heavy Technology Industries, all rose by 553 points, 97 points, and 423 points; respectively.

Gold also achieved weekly gains at the expense of the US dollar by about 1.1 points after it ended last Friday’s trading around the $2,035 per ounce, compared to the previous week’s close, which recorded $2,013 per ounce.

The US dollar concluded the trading week ending on February 23 with a limited decline that came as a result of an improvement in most of the earnings reports of companies listed on the New York Stock Exchange indices over that period, most notably the technology giant Nvidia.

The dollar index, which measures the performance of the US currency against a basket of major rival currencies, fell to 103.95 points compared to last week’s closing, which recorded 104.15 points.

The DXY Index rose on a weekly basis to the highest level at 104.29 points, compared to the lowest levels in the same period, which recorded 103.52 points.

FOMC minutes, issued on Wednesday, helped limit the losses in the US dollar after the minutes suggested that the stance adopted by the Federal Open Market Committee tends not to be “in a rush” with regard to reducing interest rates.

Central Bank officials suggested that the federal interest rate may have reached its “peak,” according to the FOMC minutes, stressing that “there is no need to rush in making the decision to reduce interest rates.”

FOMC minutes also indicated that a state of “cautious optimism” regarding the progress made by the Central Bank in combating inflation prevailed within the committee’s discussions, whose members expressed their optimism regarding the moves taken by the US central bank in terms of monetary policy and that they succeeded in reducing inflation, which had previously hit its highest levels in over 40 years in early 2022.

“There will be no rate cut until the Federal Open Market Committee has ‘greater confidence’ that inflation continues to decline,” the results stated, stressing that members of the Fed’s Board of Governors first want to see more evidence that the decline in inflation is continuing before they decide when to begin to ease monetary policy, despite saying that the current interest rate hiking cycle, QT, has already come to an end.

FOMC members do not expect that it will be appropriate to reduce the federal interest rate until it is certain that inflation continues on its correct path towards 2.00%, according to the minutes.

US policymakers indicated that they are “cautiously evaluating the data that will be released in the coming period to identify the direction that inflation is taking in the long term,” stressing that upside and downside risks are increasing due to concerns about the possibility of reducing the interest rate too quickly.

Monetary policymakers at the Federal Reserve expressed their “concern about the continued rise in inflation which could cause further harm to families, especially those who have too limited means to absorb high prices, while inflation data indicated a significant decline in prices in the second half of last year.”

FOMC minutes reflected the internal debate among members of the Federal Open Market Committee about the speed of the expected interest rate cut in the coming months in light of the state of uncertainty that dominates the future outlook for the US economy.

According to the minutes, adjusting the Federal Reserve’s budget statements will receive greater attention from the committee and will be discussed in more depth to determine the appropriate time to stop the resale of Treasury bonds within the framework of changing the direction of monetary policy after a long period of resale to combat hot inflation.

Corporate Earnings

Corporate profits had a significant influence on the price action of assets traded in global financial markets, especially Nvidia’s earnings report, whose revenues exceeded more than 260% in the last quarter of last year compared to the profits recorded for the same period last year.

A number of companies listed on global stock indices issued earnings reports for the fourth quarter of last year, most of which were positive, with optimism dominating the markets and risk assets rising against safe haven assets at the end of last week.

Moderna Pharmaceuticals’ profits exceeded market expectations, turning into profits of 50 cents per share, compared to losses indicated by LSEG, formerly known as Refinitiv, forecasts of about 97 cents per share. The company’s revenues rose to $2.81 billion in the same period, compared to expectations that indicated $2.5 billion, despite the significant decline in sales of anti-Covid vaccines.

Mercedes Motors’ profits also rose to levels slightly higher than market expectations, recording €4.33 billion before deducting interest and taxes. The European giant automaker ‘s revenues also rose to €19.66 billion.

The most important and influential earnings report on the markets was Nvidia’s financial performance report, which highlighted the company’s tremendous financial growth and a sharp improvement in the profits as well as revenues in 2023’s Q4.

Nvidia announced profits that exceeded market expectations after the closing bell last Wednesday on Wall Street for the last quarter of 2023, anticipating a significant improvement in its sales in the current quarter.

The company recorded profits of $5.16 per share, compared to expectations published by “LSEG”, formerly known as Refinitiv, which indicated $4.64 per share.

The company’s revenues in the fourth quarter of 2023 amounted to $22.10 billion, compared to the expectations of “LSEG”, formerly known as Refinitiv, which indicated revenues not exceeding $20.62 billion.

Nvidia achieved an increase in revenues of 265% in the last quarter compared to the levels recorded in the same period last year, supported by strong sales of the electronic chips sector for artificial intelligence products, especially “Hopper” electronic chips such as “H100”.

Economic Data

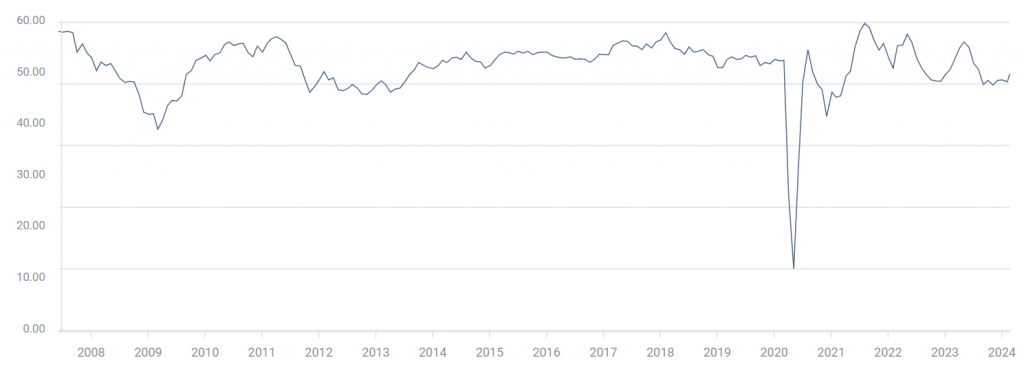

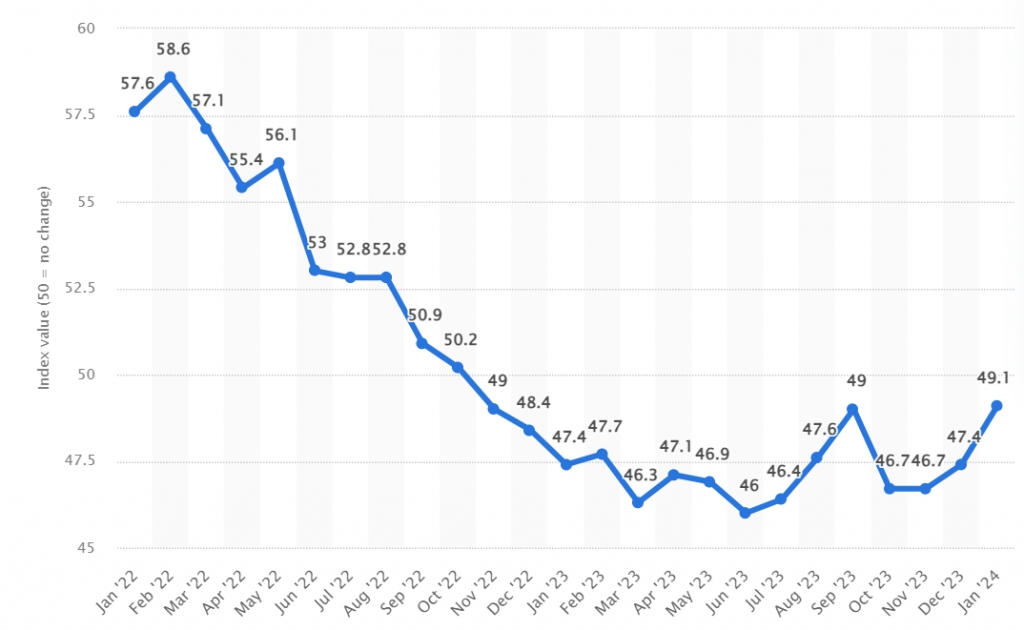

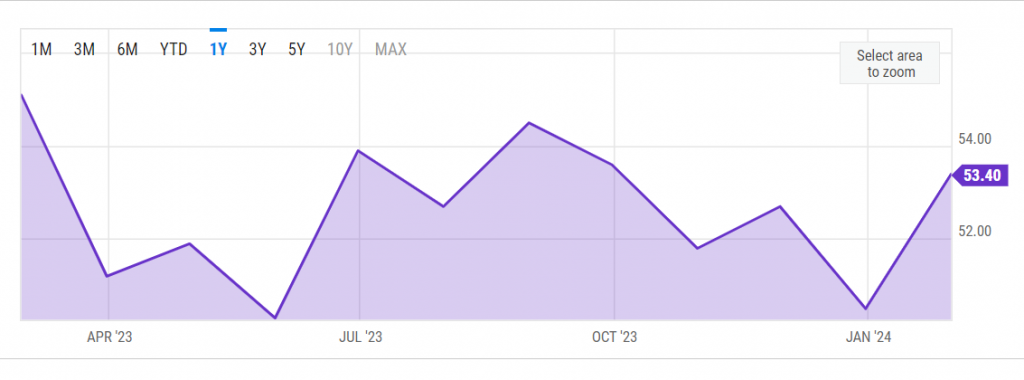

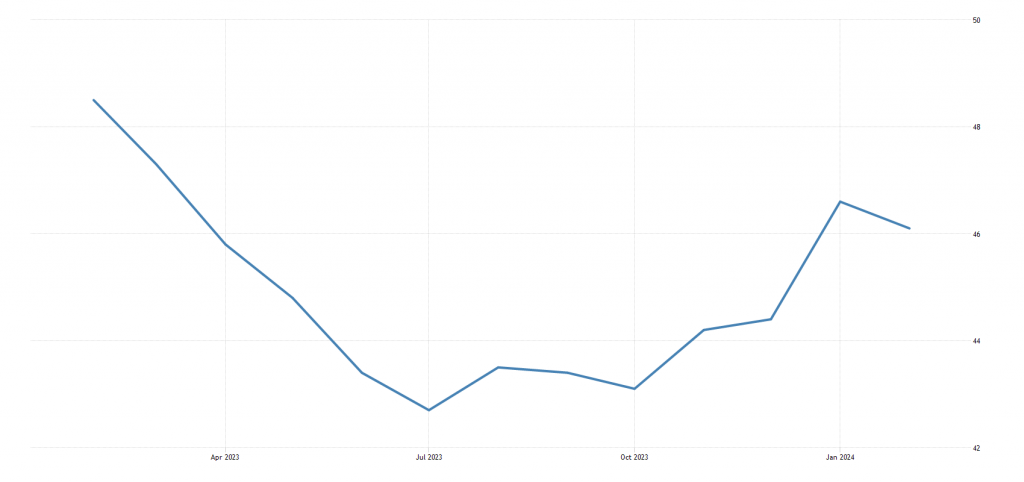

Economic data had its share of influence on the price action across financial markets, shaping the course of trading transactions last week. The most important data was mainly related to economic activity, whether in the United States or in the Eurozone.

Consumer price indices for the Eurozone showed stability last January on all levels, as the monthly and annualized indices, which exclude food and energy prices and those that do not exclude them, stabilized at the same levels recorded in the previous month.

The Eurozone Services Purchasing Managers’ Index also recorded an increase to 50 points this February, compared to the previous reading of 48.4 points, which was higher than market expectations that indicated a rise to 48.8 points.

The Eurozone Manufacturing Purchasing Managers’ Index (PMI) fell to 46.1 points in February, compared to the previous reading of 46.6 points, which was lower than market expectations that indicated a rise to 47.00 points.

The Composite Purchasing Managers’ Index (PMI) reading for the Eurozone highlighted an increase to 48.9 points in February, compared to the previous reading of 47.9 points, which was higher than market expectations that indicated a rise to 48.5 points.

These readings are preliminary and subject to review later, with the final readings appearing this February, which are scheduled to be issued later on. Nevertheless, this preliminary evidence has great importance and significant impact on markets.

The US services Purchasing Managers’ Index fell to 51.3 points in February, compared to the previous reading of 52.5 points, which was lower than market expectations that indicated a rise to 52.00 points.

The Manufacturing Purchasing Managers’ Index in the United States rose to 51.5 points in February, compared to the previous reading of 50.7 points, which was higher than market expectations that indicated a rise to 50.5 points.

The composite PMI reading for the United States highlighted a decline to 51.4 points in February, compared to the previous reading of 52.00 points. These are also preliminary readings that may witness a change when the final readings are issued.

The Week Ahead

US inflation data and important earnings reports are at the top of the agenda of important events that will shape next week’s financial markets’ environment, particularly since the looming events are closely related to the future path of interest rate policy by the Fed and economic activity. investors are awaiting clues by taking a closer look at the looming data as well as the awaited corporate earnings.

The Personal Consumption Expenditures Index (PCE) reading will be released in the United States next week, it is the Fed’s favourite and the most reliable index in terms of determining the state of inflation and prices in the country.

The Fed, ahead of investors, is focusing on the PCE data in search of more evidence that consumer prices in the United States are still continues to decline in the recent period. If this evidence is available, PCE data is expected to benefit risk-linked assets, led by US stocks.

It is also expected that, if consumer spending indicators show a further decline in inflation, gold will benefit from the looming PCE reading at the expense of the US dollar, whose calculations may be disturbed by rising expectations that the Fed may cut interest rates soon.

The markets are also awaiting a number of earnings reports for major companies next week, most notably Salesforce, Paramount, Unity Software, AutoZone, Royal Bank of Canada, Hewlett-Packard, Best Buy, and RedNet.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations