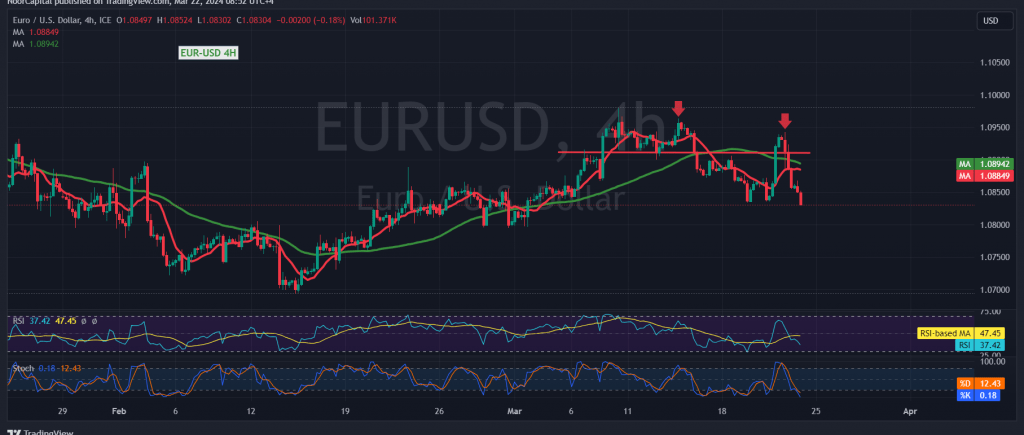

The Euro/Dollar pair experienced positive trading during the previous session, initially pushing against the 1.0940 resistance level before encountering resistance. However, the pair began today’s session with a bearish tone, failing to sustain trading above the psychological barrier of 1.0900 and currently trading around 1.0830.

From a technical perspective, examining the 4-hour chart reveals a negative intersection of the simple moving averages, exerting downward pressure on the price. Additionally, a double top pattern has formed, further indicating potential negativity. However, the Stochastic indicator is hovering around overbought territory, suggesting a possible upward movement later on.

Given these conflicting signals, it’s advisable to monitor the pair’s price action for further clarity. Here are the potential scenarios:

- Breaking below the support level of 1.0800 could initiate a bearish correction, targeting 1.0765 initially, with possible further decline towards 1.0730.

- To resume the upward trend, the price would need to consolidate above 1.0885, particularly 1.0900. Achieving this would pave the way for a visit to 1.0960 as the initial target.

Warning: Today’s trading may be influenced by a speech from Jerome Powell, Governor of the Federal Reserve, which could lead to increased price volatility.

A word of caution: Today’s trading landscape is punctuated by the release of impactful economic data emanating from the American economy, notably the “Consumer Confidence Index.” Consequently, heightened volatility is anticipated upon the dissemination of this news.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations