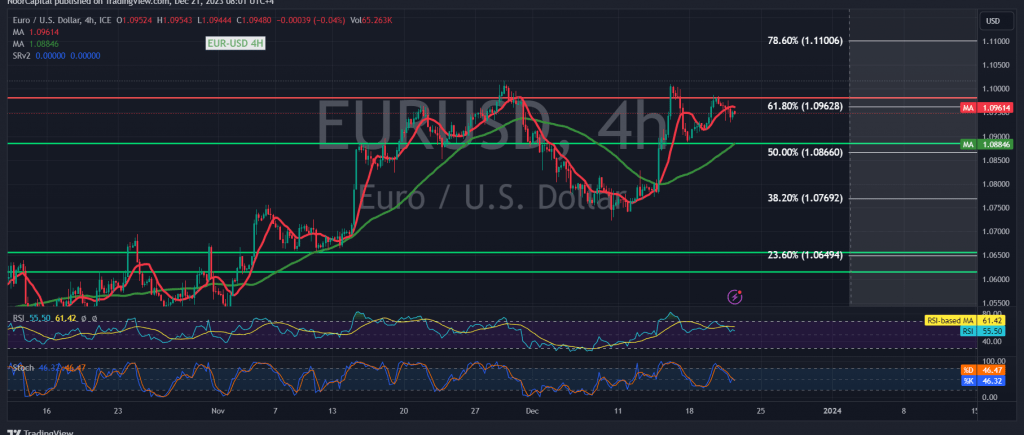

The recent trading session showcased predominant positive movements in the Euro/Dollar pair’s trajectory, as it endeavored to establish consolidation above the pivotal 1.0960 resistance level, achieving its peak at 1.0984.

From a technical standpoint today, intraday dynamics demonstrate stability beneath the formidable 1.0960 mark, representing the robust resistance positioned at the 61.80% Fibonacci retracement. A closer examination reveals that the 50-day simple moving average is offering constructive support, yet conversely, there are emerging negative signals on the Stochastic indicator.

Our inclination leans towards a bearish outlook, albeit cautiously, anchored in the steadfastness of the price below the 1.0960 resistance. We anticipate a potential shift in sentiment upon the breach of the minor support level at 1.0920, facilitating a smoother path for the anticipated retest of 1.0860, constituting our initial target.

Cautionary Note: Today, heightened attention is warranted as we anticipate the release of impactful economic data from the American economy—the “final reading of gross domestic product” for the quarter. Consequently, we may observe heightened price volatility coinciding with the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations