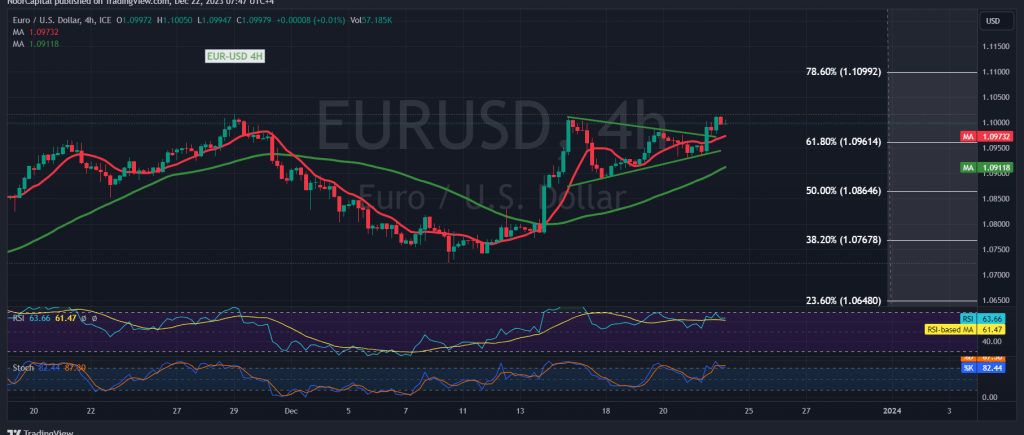

Positive trades dominated the euro’s movements against the US dollar as it successfully consolidated above the robust resistance level at 1.0960, initiating an attack on the psychological barrier of 1.1000 and subsequently stabilizing around it.

On the technical front today, intraday movements demonstrate stability above the previously breached resistance, now converted into a support level at 1.0960, represented by the 61.80% Fibonacci retracement, as illustrated on the chart. This positive momentum is reinforced by the 50-day simple moving average, which has ascended from below to support the current price.

With intraday trading persisting above 1.0960, there exists the potential to resume an upward trajectory towards the initial target of 1.1040. Surpassing this level would further strengthen gains, paving the way for reaching the ultimate target of 1.1070.

A closure below 1.0950 for at least an hour places the pair under negative pressure, with the objective of retesting 1.0900. In general, the short-term trend remains bullish unless there is trading below 1.0860, marking the 50.0% correction.

Warning: Today, high-impact economic data is expected from the American economy, including the “annual/monthly core personal consumer spending prices” and “Consumer Confidence” issued by the University of Michigan. From the United Kingdom, we anticipate the release of the “Retail Sales” indicator.

Concerning the Canadian economy, the monthly “Gross Domestic Product” index is noteworthy. Significant price volatility may occur at the time of news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations