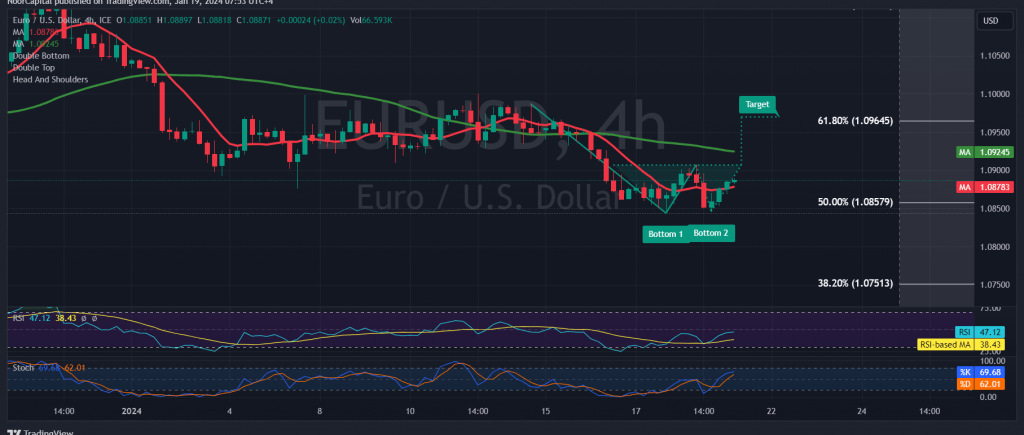

We maintained an intraday neutral stance in our previous technical report, citing conflicting technical signals. The EUR/USD pair exhibited limited changes during the last trading session, fluctuating between levels just above 1.0850 and slightly below the psychological resistance barrier of 1.0900.

In today’s technical analysis, a closer examination of the 4-hour timeframe chart reveals the pair’s attempt to establish positive stability above the 1.0860 support level, represented by the 50.0% Fibonacci retracement. This coincides with the Stochastic indicator showing signs of a potential positive crossover. Conversely, the 50-day simple moving average exerts downward pressure from above. Trading stability persists below the key resistance at the current trading levels of 1.0960, constituting the 61.80% correction.

Despite the inclination towards a positive outlook arising from the emergence of a bullish technical structure, we favor confirmation through a breach of the 1.0910 level. This activation would amplify the pattern’s positive impact, setting an initial target at 1.0960.

Given the ongoing conflict in technical signals and trading within critical correction ranges, we opt to closely monitor price behavior for potential scenarios:

- Uptrend Confirmation: A clear and robust breach of the 1.0960 resistance level, representing the 61.80% Fibonacci retracement, would strengthen the likelihood of reaching 1.1000 and subsequently 1.1040.

- Downtrend Resumption: A break below the 1.0860 support level, constituting the 50.0% correction, confirms a resumption of the downward path. This development would pave the way for a visit to 1.0800 and 1.0760, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations