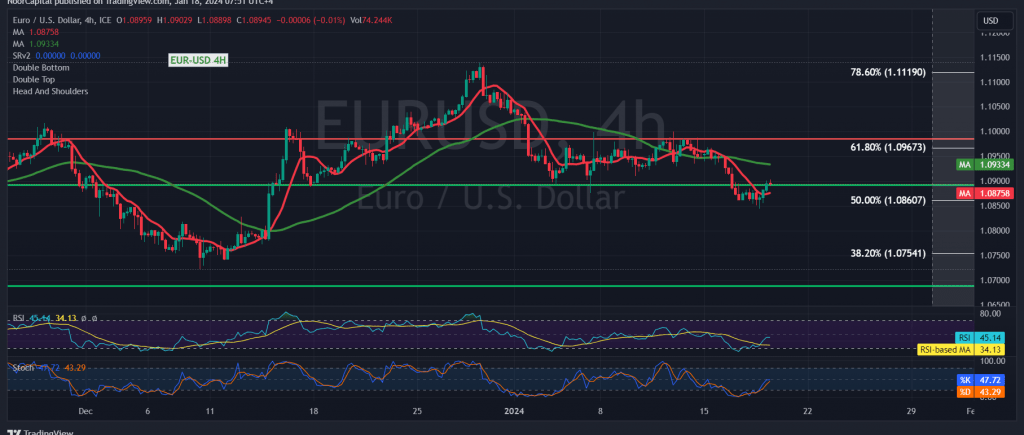

The EUR/USD pair experienced a session leaning towards negativity, aligning with the anticipated bearish trajectory from the previous report and reaching a low of 1.0844.

From a technical standpoint today, examining the 4-hour timeframe chart reveals the pair’s attempt to establish positive stability above the 1.0860 support level, marked by the 50.0% Fibonacci retracement. Additionally, the Stochastic indicator is signaling a potential positive crossover. However, the 50-day simple moving average continues to exert downward pressure on the price. Furthermore, the pair is trading below the primary resistance at the current levels of 1.0960, corresponding to the 61.80% correction.

Given these conflicting technical signals and the current trade within crucial correction levels, it is advisable to monitor the price action for potential scenarios:

- Uptrend Confirmation: A clear and robust breach of the 1.0960 resistance level (61.80% Fibonacci retracement) would act as a catalyst, enhancing the likelihood of reaching 1.1000 and subsequently 1.1040.

- Resumption of Downtrend: Confirmation of the downward trajectory involves breaking the 1.0860 support level (50.0% correction), facilitating a potential move towards 1.0800 and 1.0760, respectively.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations