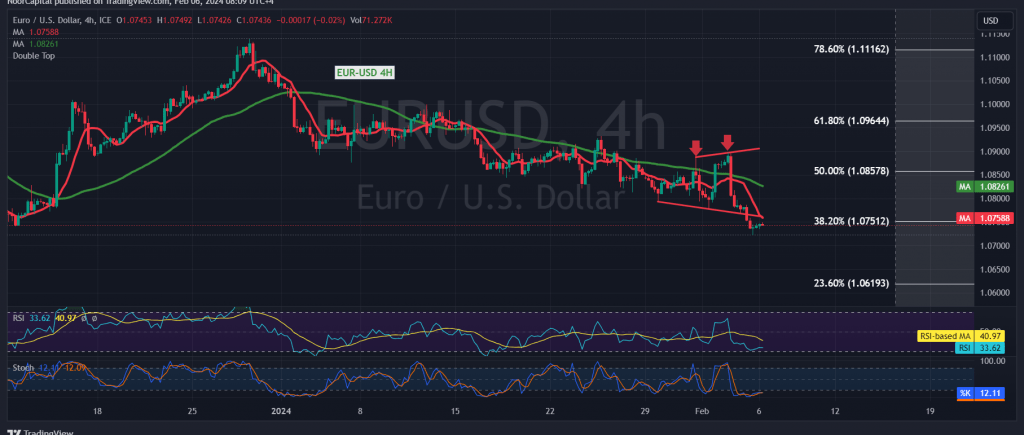

The EUR/USD pair has once again succumbed to the official bearish trend, failing to sustain trading above the crucial 1.0860 level. During the previous trading session, it reached its lowest point at 1.0715, signaling a resurgence of bearish sentiment.

Technical Analysis

Simple Moving Averages and Fibonacci Retracement

On the technical front, a closer examination of the 4-hour time frame chart reveals that the simple moving averages are exerting downward pressure on the price. Furthermore, the pair is struggling to maintain stability below the previously breached support level at 1.0860, which corresponds to the 50.0% Fibonacci retracement.

Outlook and Targets

Maintaining Negative Expectations

In light of the prevailing technical indicators, we continue to maintain a negative outlook for the EUR/USD pair. A decisive break below 1.0715 would pave the way for further downside momentum, with the next target anticipated at 1.0685. Subsequent downward targets may extend towards 1.0645.

Potential Reversal Scenarios

Conditions for Reversal

It’s important to note that a reversal scenario could materialize if the pair manages to breach the resistance at 1.0780, accompanied by a sustained closing of the hourly candle above this level. However, such a scenario would only postpone the bearish outlook rather than negate it entirely. Temporary recovery attempts could ensue, aiming to retest resistance levels at 1.0820 and 1.0860 before the bearish trend resumes.

Conclusion and Tactical Considerations

Navigating Market Dynamics

As the EUR/USD pair grapples with technical pressures and market sentiment, traders should remain vigilant for potential shifts in momentum. The prevailing bearish trend underscores the importance of closely monitoring key support and resistance levels, as well as any developments that could influence market sentiment. A disciplined approach to risk management and a keen awareness of technical signals will be essential for navigating the complexities of the currency pair in the days ahead.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations