The EUR/USD pair has initiated an assault on the primary resistance level at current trading levels around 1.0960, reaching its highest point close to the psychological barrier of 1.1000.

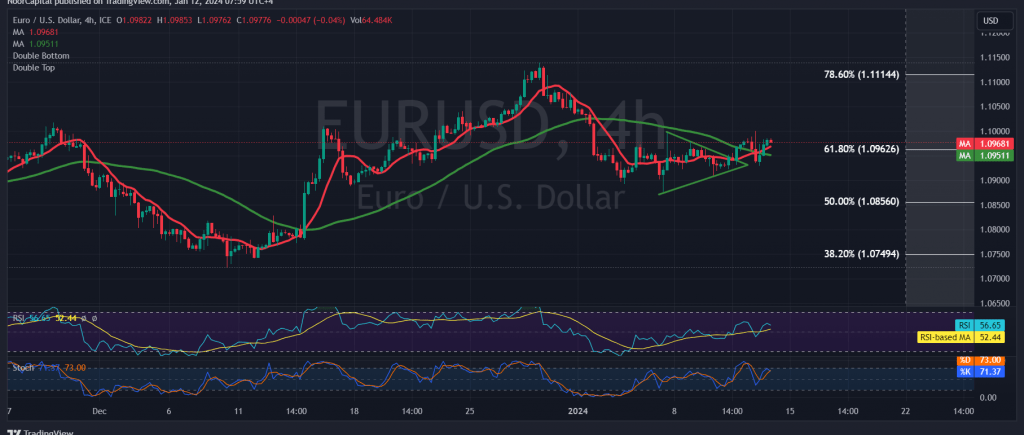

Upon examining the 4-hour time frame chart from a technical analysis perspective, the simple moving averages provide a positive indication, supporting the possibility of an upward movement. Additionally, there’s an attempt at positive intraday stability above 1.0960, a resistance level represented by the 61.80% Fibonacci retracement.

The overall sentiment tends to be positive, contingent on observing consolidation above the mentioned resistance. A breakthrough above the psychological barrier of 1.1000 would be a significant catalyst, making it easier to target 1.1040 as the first objective and then 1.1080 as the subsequent key level.

However, if the pair fails to consolidate above 1.0960 and closes at least a one-hour candle below it, a shift in momentum may occur, bringing back control to the downside. A breach below 1.0940 would exert negative pressure, with attention turning to 1.0900 and subsequently 1.0860, the 50.0% Fibonacci retracement, as the next critical support level.

Caution is advised as the market awaits high-impact economic data from the American economy, specifically the “monthly core producer prices” and the “monthly producer price index.” Additionally, the “monthly gross domestic product” indicator from the United Kingdom is anticipated, which may lead to heightened volatility during the news release.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations