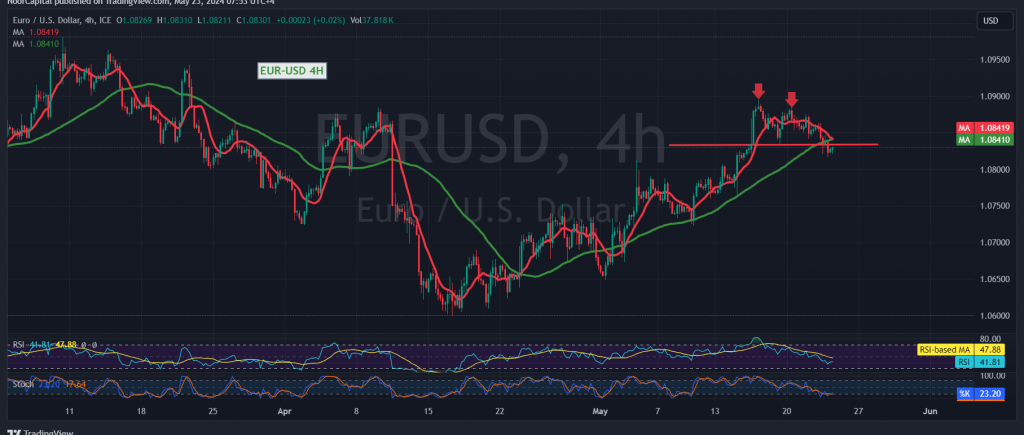

The EUR/USD pair maintained its bearish trajectory in the previous session, trading negatively below the 1.0875 resistance level and reaching a low of 1.0817.

Technical Analysis

A closer examination of the 240-minute chart reveals:

- Stochastic Indicator: Provides negative signals, supporting the potential for further decline.

- Moving Averages: Negative intersection of simple moving averages pressures the price from above.

- Bearish Formation: The chart shows a bearish technical formation.

Downward Targets

With daily trading remaining below the extended resistance levels of 1.0875 and 1.0900, the downward trend is likely to continue. Key targets include:

- First Target: 1.0800. Breaking below this level could lead to further declines.

- Initial Target: 1.0730.

Potential Reversal

If trading stabilizes above 1.0900, the bearish scenario could be invalidated, leading to a potential recovery. Key targets in this case include:

- First Target: 1.0970.

Market Volatility Alert

Today, we anticipate significant market volatility due to the release of high-impact economic data, including the preliminary readings of the services and manufacturing PMI indices for France, Germany, the United Kingdom, and the United States.

EUR/USD Analysis: Bearish Momentum Amid Key Economic Data

The EUR/USD pair maintained its bearish trajectory in the previous session, trading negatively below the 1.0875 resistance level and reaching a low of 1.0817.

Technical Analysis

A closer examination of the 240-minute chart reveals:

- Stochastic Indicator: Provides negative signals, supporting the potential for further decline.

- Moving Averages: Negative intersection of simple moving averages pressures the price from above.

- Bearish Formation: The chart shows a bearish technical formation.

Downward Targets

With daily trading remaining below the extended resistance levels of 1.0875 and 1.0900, the downward trend is likely to continue. Key targets include:

- First Target: 1.0800. Breaking below this level could lead to further declines.

- Initial Target: 1.0730.

Potential Reversal

If trading stabilizes above 1.0900, the bearish scenario could be invalidated, leading to a potential recovery. Key targets in this case include:

- First Target: 1.0970.

Market Volatility Alert

Today, we anticipate significant market volatility due to the release of high-impact economic data, including the preliminary readings of the services and manufacturing PMI indices for France, Germany, the United Kingdom, and the United States.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations