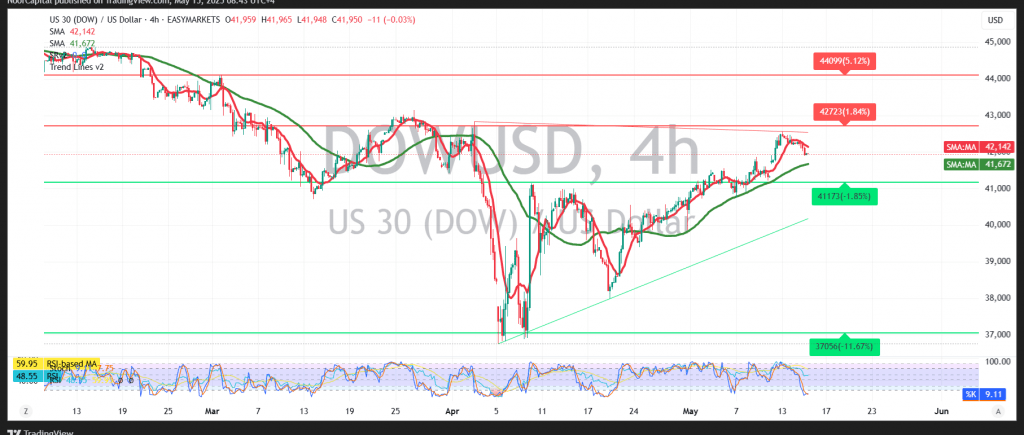

The Dow Jones Industrial Average experienced negative trading momentum during the latest Wall Street session, reaching a new session low of 41,898.

From a technical standpoint, the short-term trend remains bearish, as indicated by continued downside pressure from the Relative Strength Index (RSI), which reflects weakening momentum. However, simple moving averages are still offering a layer of support, providing a potential buffer against further declines.

Given the presence of conflicting signals, it is prudent to monitor price behavior closely to determine the next directional move. Two key scenarios are currently in play:

- Bullish Scenario: A sustained hold above the 41,875 support level could help stabilize the index, with a potential rebound toward the 42,230 resistance level as an initial upside target.

- Bearish Scenario: A confirmed break below 41,875 would likely accelerate selling pressure, with the next downside target at 41,620.

Key Event Risk Today:

Expect heightened volatility due to major U.S. economic releases, including:

- Retail Sales

- Producer Price Index (PPI)

- Unemployment Claims

- Speech by a Federal Reserve Governor

These events may significantly influence market sentiment and DJIA performance.

Risk Disclaimer: With ongoing global trade tensions and pivotal economic data in focus, market risk remains elevated. Traders should exercise caution and be prepared for rapid market shifts across a wide range.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations