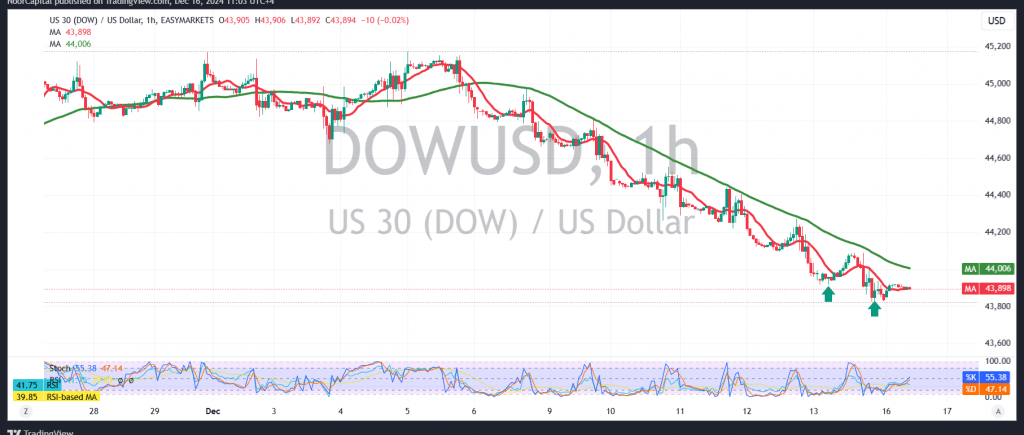

The Dow Jones Industrial Average experienced a sharp downtrend as anticipated, reaching the second target of 43890 by the end of last week’s trading and recording a low of 43822.

From a technical perspective, although the prevailing factors point to a continued bearish outlook, a temporary upward correction is anticipated. This is supported by the RSI attempting to generate positive signals, which could fuel short-term gains.

As long as intraday trading remains stable above 43760, the index may retest 44060, and a break above this level could pave the way for 44210. However, it is essential to note that this upward movement aligns with a corrective scenario and does not conflict with the broader downtrend. Conversely, breaking below 43785 would invalidate the temporary bullish outlook and lead the index toward 43670.

Warning: The risk level remains elevated and may not align with the expected return, requiring careful consideration.

Warning: Given ongoing geopolitical tensions, all scenarios remain possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations