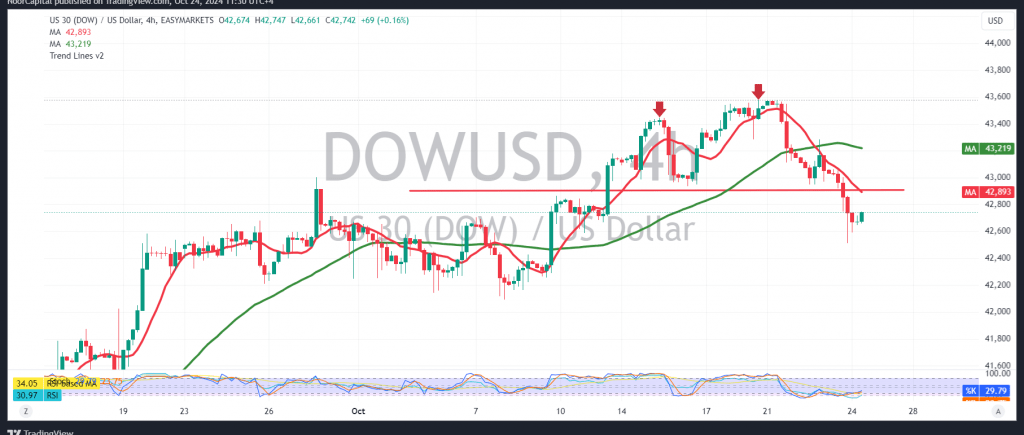

The Dow Jones Industrial Average experienced positive trading at the start of the week, reaching a high of 42690.

Technical Analysis:

- Currently, we maintain a cautiously optimistic outlook. The simple moving average is attempting to support the price from below, while the 14-day momentum indicator is also providing positive signals.

- With daily trading remaining above the support level of 42410, there is potential for an upward trend in the short term, targeting 42695. A breach of this level could enhance the likelihood of reaching 42840.

- For this positive scenario to be activated, it is crucial for the index to remain above the support level of 42410. If the price falls below this level, it may face negative pressure, potentially targeting 42260.

Warnings:

- Be aware that the risk level may be high and not align with the expected return.

- High-impact economic data from the US, including Consumer Confidence, Job Openings, and Labor Turnover, is expected today, which could result in significant price volatility during the news release.

- The risk level remains elevated amid ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations