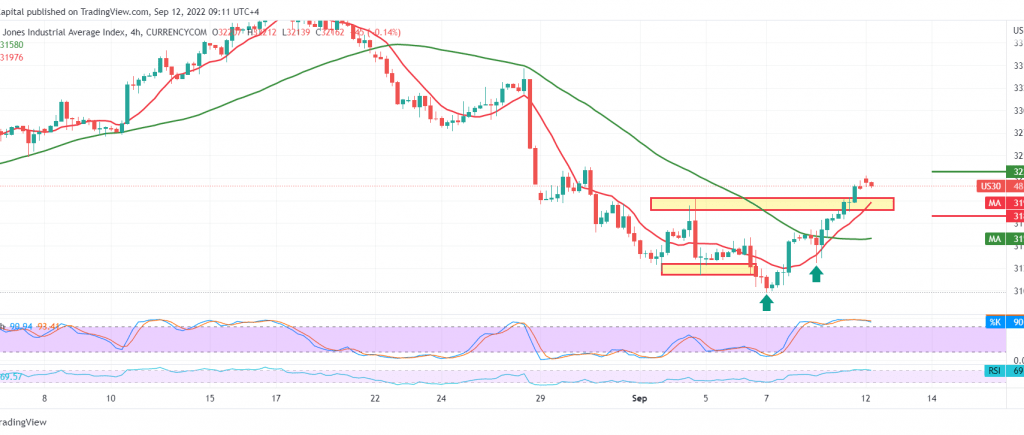

The Dow Jones Industrial Average achieved strong gains within the expected positive technical outlook, touching the official target required at the price of 32,240, recording its highest level at 32,275.

On the technical side today, and by looking at the chart with a 60-minute interval, we find that the RSI continues to defend the daily bullish trend, stable above the 50 mid-line, in addition to the index’s base building above the 32,000 points.

Therefore, the daily trend may be cautiously bullish, knowing that the upside and cohesion above 32,170 increases and accelerates the strength of the bullish trend, so we will be waiting for 32,245 first target and then 32,320 next stop unless we witness any trading below 32,000.

The return of trading stability below the mentioned support level can thwart the suggested scenario and put the index price under strong negative pressure, with its initial target of 31850.

Note: the risks are high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations