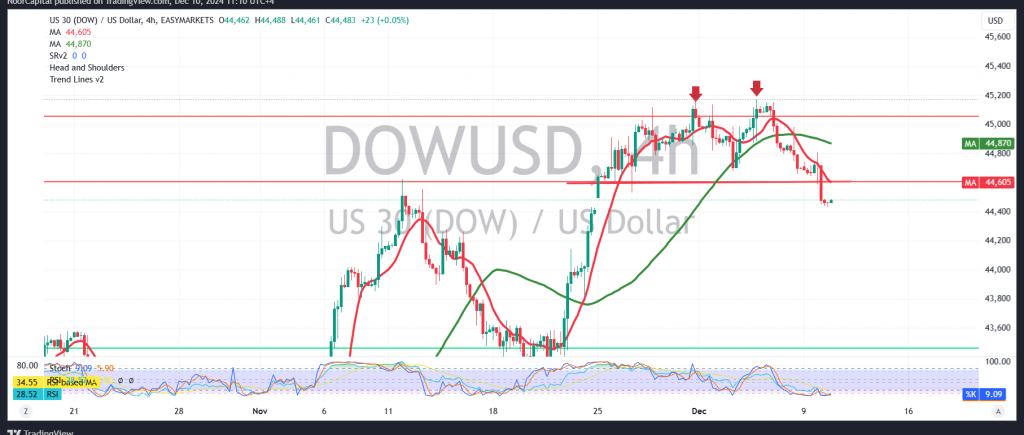

The Dow Jones Industrial Average declined significantly during yesterday’s U.S. session, aligning with the expected negative outlook, reaching the required official targets, and touching the final target at 44445, recording its lowest level at 44433.

The technical outlook today suggests a continuation of the downward trend due to sustained negative pressure from the simple moving averages and bearish signals from the 14-day momentum indicator.

As long as trading remains below the pivotal resistance level at 44680, and more critically 44715, the bearish trend is likely to persist. The first target is 44340, and a break below this level will intensify the downward trend, paving the way for a potential drop to 44200.

Conversely, should the price breach and stabilize above 44715, the bearish scenario will be nullified, and the index may recover, targeting 44950 as an initial station.

Warning: The risk level is high and may not align with the anticipated return, necessitating careful consideration.

Warning: The risk level remains elevated amid ongoing geopolitical tensions, making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations