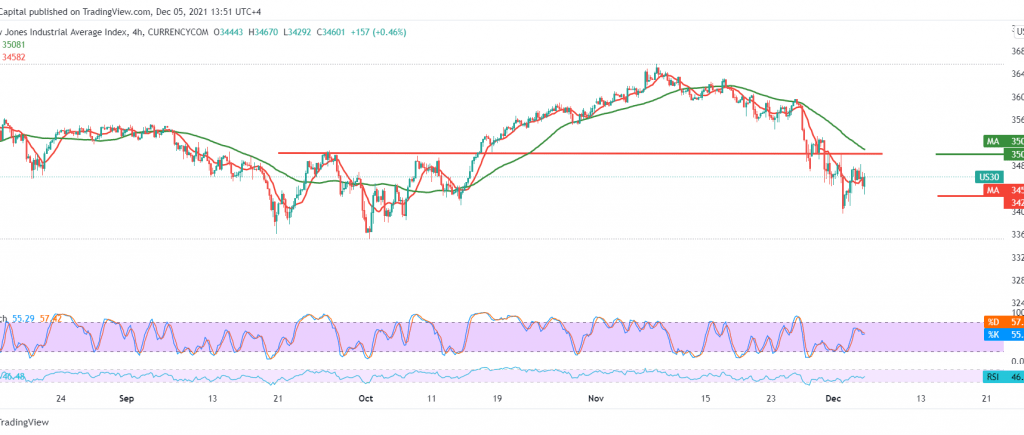

Mixed trading dominated the movements of the Dow Jones Industrial Average, ending its weekly trading last Friday around 34,570.

On the technical side, today, we find the 50-day moving average holding the price, in support of a bullish bias during today’s trading session, which contradicts the stability of the RSI and the stability of trading below the resistance level of 34,830.

We tend to be negative, but with great caution, knowing that below the 33,770 support level puts the index’s price under intense negative pressure. Its initial target is around 34,280.

The stability of trading above 34,830 leads the index to obtain some bullish momentum, with initial targets starting at the psychological barrier of 35,000, before retracing.

Note: The risk level is high.

| S1: 34280 | R1: 34830 |

| S2: 33990 | R2: 35080 |

| S3: 33730 | R3: 35370 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations