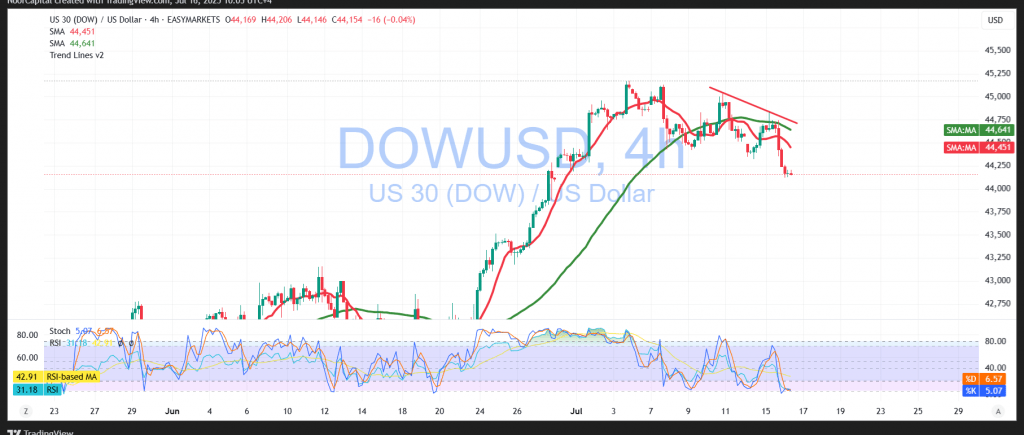

The Dow Jones Industrial Average saw a sharp decline during yesterday’s trading session, impacted by the release of U.S. inflation data, and recorded a session low of 44,118 points.

Technical Outlook for Today’s Session:

From a technical perspective, simple moving averages have resumed their role as dynamic resistance, applying downward pressure on price action. This is further supported by a noticeable weakening in bullish momentum, as reflected by the Relative Strength Index (RSI), which increases the likelihood of a continued downtrend.

Probable Scenario – Bearish Bias:

If the index breaks below 44,120 with a confirmed close, it would likely extend its losses, targeting:

- 43,940 as the initial support level

- Followed by 43,720 as the next key support

Alternative Scenario – Bullish Recovery:

On the other hand, if the index manages to regain bullish momentum and break above 44,565, holding that level, this could signal a potential rebound and reactivation of the broader upward trend, with 45,190 as the next upside target.

Market Catalyst:

Today’s focus shifts to the upcoming release of high-impact U.S. economic data, particularly the monthly and annual Core Producer Price Index (PPI). This could generate significant volatility across equity markets.

Caution:

Risk remains elevated amid continued geopolitical and trade-related tensions. All scenarios are possible, and strong risk management is recommended.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations