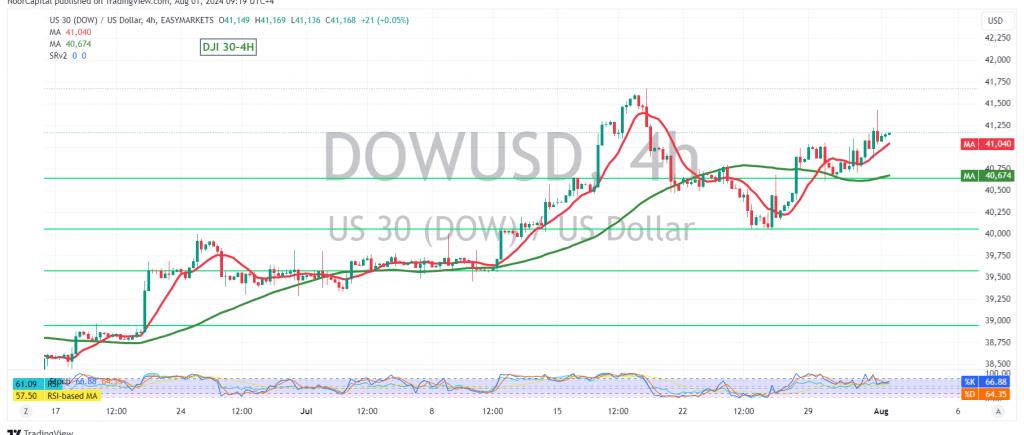

The Dow Jones Industrial Average experienced solid gains on Wall Street during the previous trading session, reaching a high of 41,425.

From a technical perspective, the outlook appears positive. The index has successfully held above the support level of 40,875, supported by favorable conditions from the simple moving averages and positive signals from the 14-day momentum indicator.

There is potential for an upward trend today, with an initial target of 41,440. A break above this level could further extend gains, with the next target set at 41,710.

Conversely, if the index falls below 40,875, it may come under negative pressure, potentially leading to a retest of 40,585.

Caution: The risk level may be high and may not align with the expected return. Additionally, today’s high-impact economic data releases from the British economy—including the interest rate decision, monetary policy summary, MPC vote on interest rates, and a speech by the Bank of England Governor—and from the US economy—unemployment benefits and manufacturing PMI—could result in significant price volatility.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations