The Dow Jones Industrial Average (DJI30) maintained its strong upward momentum on Wall Street, supported by a series of record closes in the US stock market.

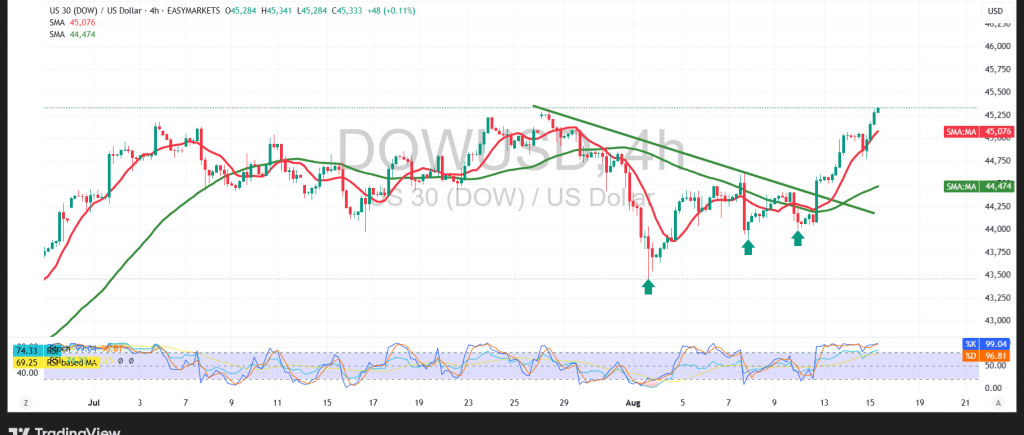

Technical Outlook – 4-hour timeframe:

The index remains firmly positioned above the 50-period simple moving average, which strengthens the probability of continued bullish movement. The Relative Strength Index (RSI) is also providing additional positive momentum, reinforcing the upward bias.

Likely Scenario:

As long as the price holds above 44,950, the outlook stays positive, with the next targets at 45,495 followed by 45,520. Conversely, a break below 44,950 could trigger selling pressure, pushing the index toward 44,570 as initial support.

Fundamental Note:

Today’s session will feature high-impact US economic data, including retail sales, preliminary Michigan consumer confidence, and preliminary Michigan inflation expectations, which could lead to notable volatility upon release.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations