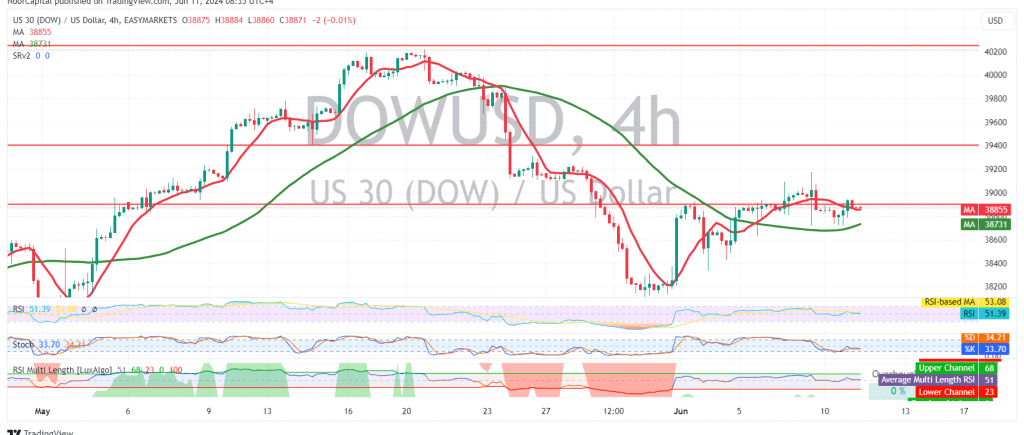

The Dow Jones Industrial Average continues to exhibit sideways movement within a defined price range, reflecting the indecision we observed in the previous trading session.

Technically, while the simple moving averages provide short-term support for a potential rise, the Stochastic oscillator is gradually losing bullish momentum and generating negative signals. This divergence in indicators suggests caution is warranted.

Scenario 1: Downside Break

A break below the 38740 support level could expose the index to further downside pressure, with a potential retest of the 38620 level.

Scenario 2: Upside Breakout

Conversely, a decisive move above the 38965 resistance level, with subsequent consolidation, would strengthen the bullish case. This could pave the way for the index to reach 39070 and potentially 39130.

Key Points:

- The Dow Jones Industrial Average remains range-bound, with conflicting technical signals.

- The 38740 and 38965 levels are crucial to monitor for potential breakouts or breakdowns.

- Traders should exercise caution and consider both upside and downside scenarios.

- Given the ongoing geopolitical tensions and potential for high volatility, risk management is paramount.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations