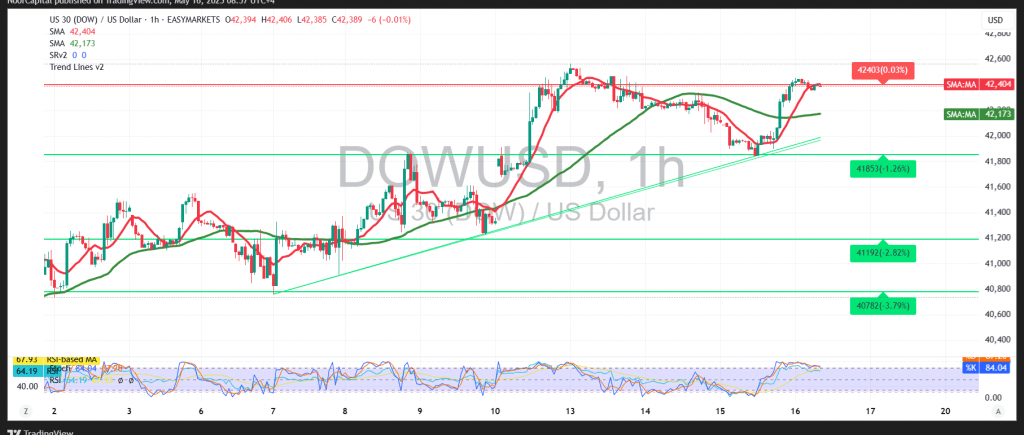

In our previous technical report, we maintained a neutral stance, noting the importance of monitoring price action near the 41,875 support level. This level held firm and successfully propelled the index toward our initial upside target of 42,230, eventually surpassing it to reach a high of 42,453.

Looking ahead, continued intraday stability above 42,230, and more broadly above 42,000, supports the case for further bullish progress. A sustained move above 42,450 would likely accelerate the upward trend, bringing 42,610 into view as the next key resistance.

However, failure to hold above 42,230 could signal a loss of bullish momentum, prompting a possible retest of the 42,000 level. A confirmed break below 42,000 would mark a shift in sentiment, placing the index under strong downward pressure, with 41,620 as the next downside target.

Risk Disclaimer:

Amid ongoing global trade tensions and economic uncertainty, volatility remains high. Traders should remain alert and prepared for rapid market shifts in either direction.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations