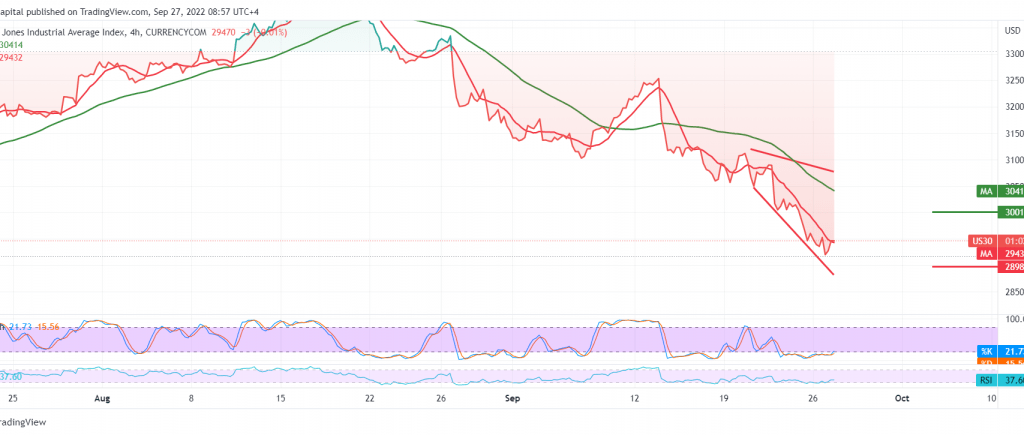

The Dow Jones Industrial Average incurred heavy losses within the lowest closing level from November 2020, recording the lowest at 29,224 within a strong oversold that dominated the performance of the markets last Friday.

Technically, the general trend is still dominating the index’s movements, accompanied by the strong negative pressure coming from the simple moving averages and the clear negative signs on the RSI.

Therefore, the continuation of the decline may be a valid and effective matter, with the price pivoting below 29,760, as we need to witness a break of 29,500, which facilitates the task required to visit 29,250, and losses may extend later towards 28,980.

We remind you that consolidation above 29,760 leads the index to recover, aiming to retest the previously broken support level, which was turned into a pivotal resistance level at 30,000.

Note: the markets are unstable and we may see random, erratic movements.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations