The Dow Jones Industrial Average continues to post notable gains, reaching its highest level during the previous session’s US trading at 42,680.

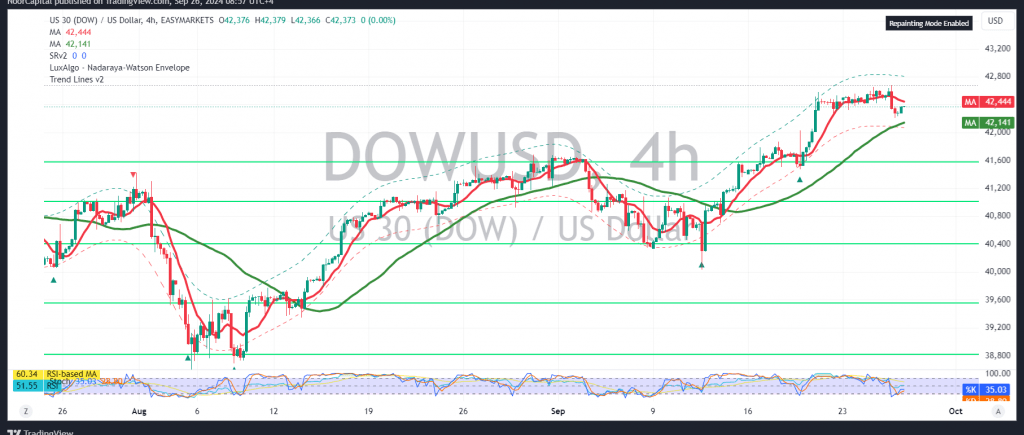

From a technical perspective today, we maintain a cautiously positive outlook, supported by the index continuing to receive positive signals from the Relative Strength Index, along with the 50-day simple moving average providing a positive incentive.

Therefore, there is a possibility of the bullish trend continuing, provided there is a clear breach of the 42,440 level, which would facilitate a move towards 42,635, with potential gains extending later to 42,890.

However, it’s worth noting that if trading stabilizes below 42,440, the index may experience temporary negative pressure, targeting 42,280 and 42,160 before attempting to rise again.

Warning: The risk level may be high and not commensurate with the expected return.

Warning: Today, we expect high-impact economic data from the US, including the final reading of GDP prices, unemployment benefits, and a speech by Jerome Powell, Chairman of the Federal Reserve. This could result in significant price volatility at the time of the news release.

Warning: The level of risk is high amid ongoing geopolitical tensions, and all scenarios are possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations