During the previous trading session, strong negative trading dominated the Dow Jones Industrial Average movements on Wall Street, recording its lowest level around 36,075.

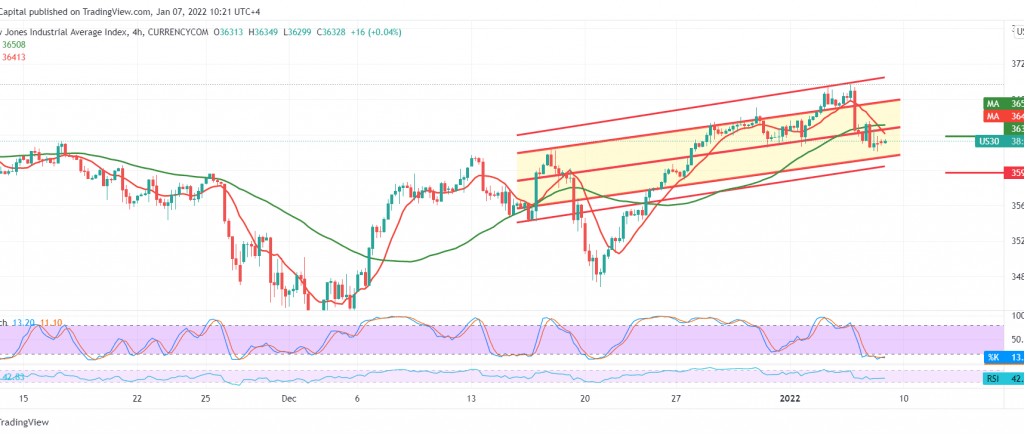

Today, with a closer look at the chart, we notice that the RSI is gaining bearish momentum on the short time frames, in addition to the clear negative signs on the stochastic indicator.

With the intraday trading remaining below 36,280 and in general, below 36,380, the bearish scenario might be the most preferred to target 36,040. Still, with cation, its failure can enhance the chances of a decline to visit 35890 next stop.

Rising above 36,380 is able to thwart the bearish bias, and the index may recover to retest 36,570.

Note: the level of risk is high

Note: US Jobs Data, average wages, and US unemployment rates are due today and may cause volatility.

| S1: 36045 | R1: 36380 |

| S2: 35890 | R2: 36570 |

| S3: 35700 | R3: 36720 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations