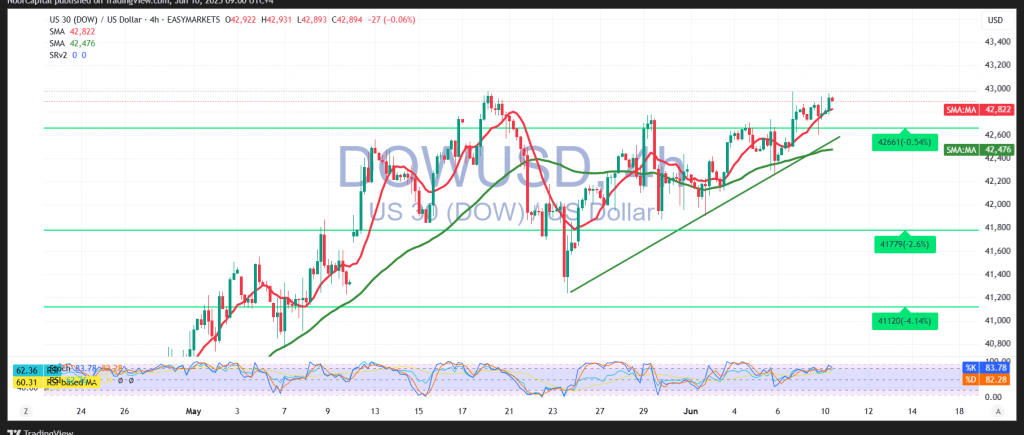

The Dow Jones Industrial Average extended its upward momentum during the previous session, reaching a new record high of 42,960, reflecting strong bullish sentiment across Wall Street.

From a technical perspective, the index remains supported by the simple moving averages, which continue to underpin the ongoing uptrend. Additionally, positive signals from the 14-day momentum indicator reinforce the potential for further gains.

Looking ahead, we maintain a cautiously bullish outlook, provided that daily trading remains above the key support level of 42,680. Under these conditions, the index is well-positioned to target 43,050 initially. A clear breakout and consolidation above this resistance zone could act as a catalyst, accelerating the rally toward 43,180, and potentially extending to 43,280.

However, traders should remain vigilant. A return to stable trading below 42,680—and especially below 42,660—would invalidate the bullish scenario, introducing the risk of a corrective pullback with an initial downside target near 42,460.

Warning: Given the current macroeconomic uncertainty and ongoing trade tensions, volatility may remain elevated. Traders should be prepared for sharp intraday swings in either direction.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations