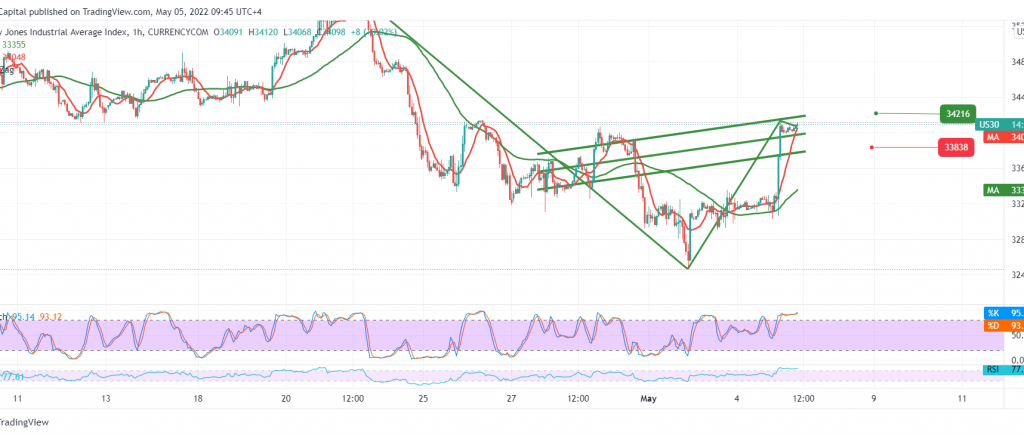

The Dow Jones Industrial Average jumped on the New York Stock Exchange with strong gains, affected by the Fed’s decision yesterday, reaching a high of 34,025.

Technically, by looking at the 60-minute chart, we find that the RSI continues to defend the bullish moves and the positive stimulus coming from the 50-day moving average.

The bullish bias may remain valid and effective, targeting 34,025 first target, considering that the confirmation of the breach of the mentioned level is a catalyst that enhances the chances of the index rising to visit 34,070 and 34,100, respectively. Gains may extend later to visit 34,200 if the price is stable above 33,875.

Note: The risk level may be high, and all scenarios are on the table.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations