The Dow Jones Industrial Average experienced mixed performance, ultimately retreating and reaching a session low of 43,174.

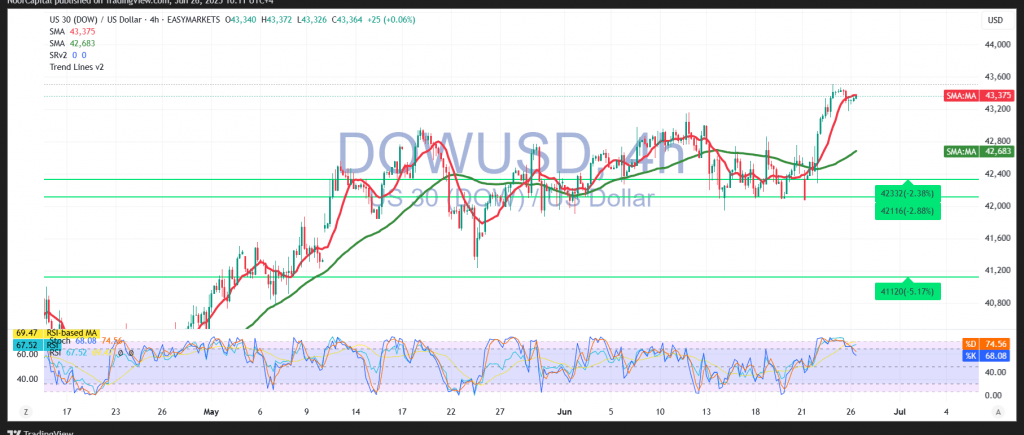

Technically, the intraday trend appears tilted upward, supported by the 50-day simple moving average, which is still attempting to inject bullish momentum. However, emerging negative signals on the Relative Strength Index (RSI) suggest that upside momentum may be weakening.

Given these conditions, the outlook leans bearish but with caution. A retest of the 43,130 support level is likely, although the bearish sentiment does not exclude the possibility of continued upward attempts. Should the price stabilize above the 43,420 resistance, the index could resume its upward path toward the next target at 43,495.

Warning: Today’s final U.S. GDP figures and weekly jobless claims could trigger sharp market movements.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations