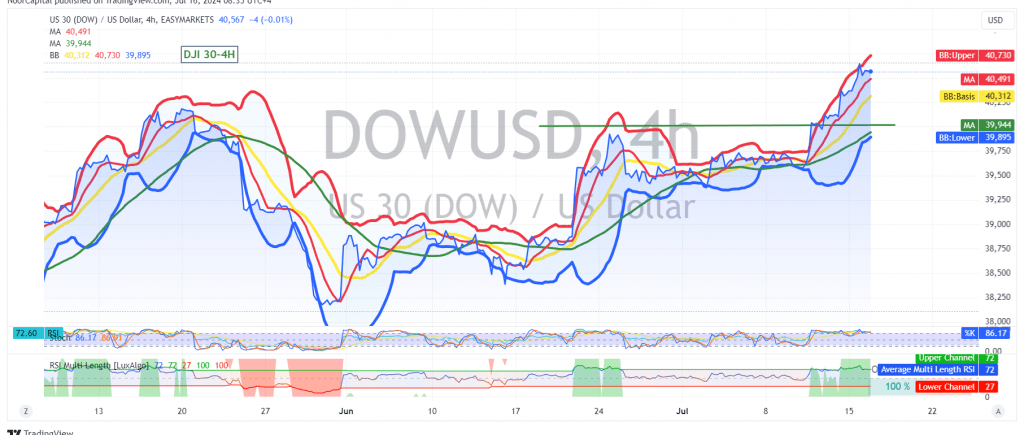

The Dow Jones Industrial Average (DJIA) has achieved record gains, reaching a high of 40,655, demonstrating a strong bullish momentum.

Technical Outlook:

While the DJIA is experiencing a minor bearish retracement due to overbought conditions, the overall technical outlook remains positive. The simple moving averages (SMAs) are still providing strong support for the upward price movement, indicating that the bullish trend is likely to continue.

Potential Correction:

We may witness a temporary bearish correction in the short term, targeting the 40320 level before resuming the upward trend. This correction is expected to be a healthy retracement within the ongoing bullish momentum.

Upward Potential:

The primary targets for the upward trend remain at 40690 and 40820. A break above these levels could further accelerate the rally.

Important Note:

The release of high-impact U.S. economic data today, including monthly retail sales and core retail sales excluding cars, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Key Levels:

- Support: 40320

- Resistance: 40690, 40820

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations