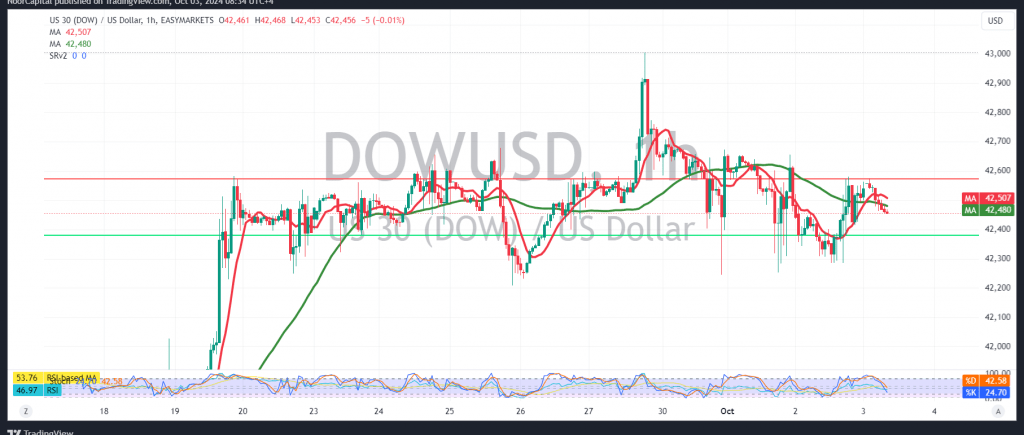

The Dow Jones Industrial Average continued to experience mixed trading during the previous session, closing around 42,460.

From a technical perspective, we adopt a cautious negative outlook, supported by pressure from the moving averages and the 14-day momentum indicator, which remains below the 50 midline.

As such, there is potential for a downward trend in the coming hours, with the first target set at 42,350. A break of this level could lead to further negative pressure, pushing the index toward 42,310.

On the other hand, if stable trading resumes above 42,600, it could invalidate the bearish scenario, leading to a recovery session with targets starting at 42,740.

Warning: The risk level may be high and could outweigh the potential return.

Alert: Upcoming US economic data releases, such as “Unemployment Benefits” and “ISM Services PMI,” may trigger significant price volatility.

Risk Warning: Geopolitical tensions remain elevated, increasing risk levels and making all scenarios possible.

Disclaimer: Trading in CFDs carries inherent risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for the Dow Jones Industrial Average.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations